With interest rates currently so low, people are on the lookout for a better return on their money and investments. So, fraudsters are using bonds — popular savings and investment products — to promote too-good-to-be-true deals, often with supposedly high returns, to lure in their victims.

Fraudsters are offering often huge returns on fake bonds

We've had several reports that criminals have been creating websites for investments offers which, at first glance, look genuine.

Scammers have also set up fake comparison-style sites to get your information and make themselves look legitimate when they contact you. As you've given your details voluntarily on these sites, you don't suspect to be a victim of an investment scam.

Criminals are also buying advertisements on search engines, such as Google and Bing, which link to their fake investing sites. These ads appear at the very top of the results page when you search ‘best rates’ and ‘best bonds’, so they instantly catch your attention with the benefits scammers claim to offer.

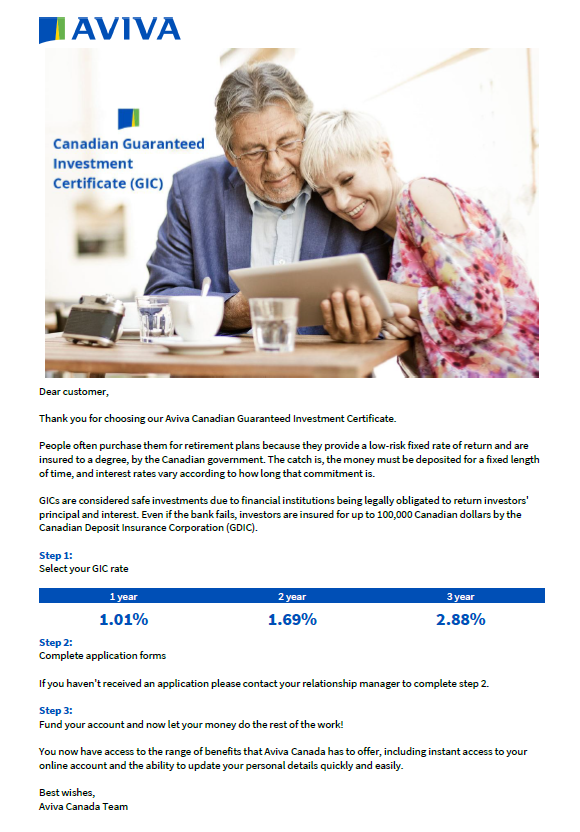

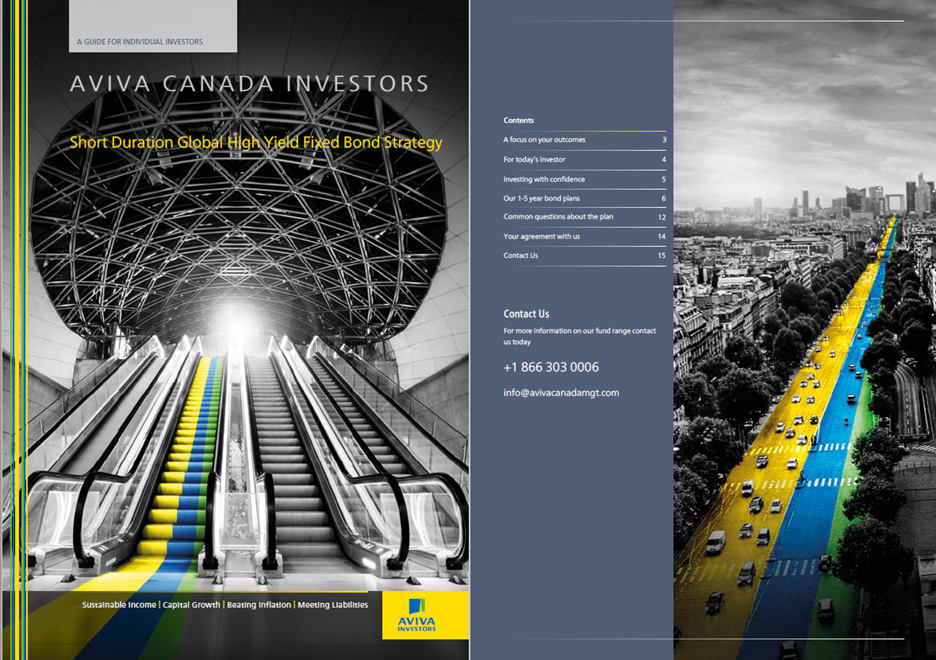

These scammers are tech savvy. They know exactly how to make investment scams look real. Scammers often include real, well-known company names when setting up fake sites, knowing people are more likely to visit them if they’ve heard of the brand.

Once you visit these scam websites, they may ask for your personal — and possibly financial — information. Some of these fraudsters have even asked people to send a photograph of themselves holding their ID. Scammers may encourage you to set up bonds or stocks with them, which turn out to be fake. They may also ask you to create an online account on a fake portal to manage your investment and financial information — this allows them to steal your password so they can try to access your financial accounts elsewhere.

Unfortunately, because you think you've gone onto a real website, you're likely to hand your information over before sending money on to the scammers. Unless it’s a web domain you recognize and know to be safe, don’t open it because it could be a scam offer.

Some of these scam criminals have then been getting back in contact with their victims, posing as lawyers, financial advisers, insurance companies, etc., and claiming they can recover their lost money. This is known as a recovery scam, designed to extort more money from investment fraud victims.

Watch how you’re being asked to make money payments

Another thing to be wary of is how you’re being asked to pay for something. You should also be suspicious of investment fraud if someone asks you to:

- pay a person instead of a business — when you’re making an online payment, you may be asked if it’s going to a person or a business. A scammer might ask you to say you’re paying a person or that it’s a ‘payment of services’. A legitimate company would never ask you to do this.

- pay a business — whose name differs from the business you think you are investing with – scammers will often ask you to transfer money into an account that has a completely different entity name.

- pay in instalments — instead of making a lump sum payment, you might be asked to pay in smaller chunks. A scammer might do this to avoid drawing attention to large transactions on their account.

- let them talk you through the payment — a scammer might insist on staying on the phone with you as you’re making a money payment online to make sure the payment reaches them.

- use an escrow account — if someone asks you to make a payment into an escrow account (in other words, a holding account), rather than paying them directly, it might be an investment scam. Think twice before making the money transfer.

An increasing trend has found fraudsters requesting Bitcoin or cryptocurrency payments because it offers anonymity- Aviva Canada does not accept Bitcoin payments.

Some fraud and investment scam sites to be wary of

With these sorts of scams, fraudsters tend to use well-known brand names on the website because they know, this way, people are more likely to trust the site and fall for the fake investment offers.

Here are some examples of websites which have tried to contact customers claiming to be Aviva, even though they have no links to us whatsoever.

- aviva-onlineinvestments.com

- avivainsurences.com

- aviva-ca.com

- wm-aviva.com

- avivacanadamgt.com

- aviva-2021.com

- aviva-ontario.com

- avivabonds.com

- avivafixedsavings.com

- avivainvestorsholdings.com

- avivaplcbonds.com

- avivauk.com

Although we know these emails haven’t been sent by us — these aren’t our email addresses — they may appear genuine. That’s why it’s important you do a bit of investigating yourself, to make sure everything checks out and that you aren't dealing with an investment scam. Doing your research and being vigilant about investment scams can help you avoid falling victim to a money fraud scheme.

Warning signs that a site might be fake

These are some signs and characteristics you can look out for to help you spot fake investment websites:

- Images on the website — are the images and logos that appear blurry or of low quality?

- Text on the website — is the website poorly written and does it include spelling or grammatical errors?

- Missing contact details — is the website missing contact details, such as an email address or phone number?

- Broken links — are there links to other parts of the website which, when clicked on, take you to a blank page or don’t take you anywhere at all?

- Too good to be true — are there offers advertised on the website which look too good to be true. Remember, with interest rates at an all-time low, you should be suspicious of investments guaranteeing such high returns.

These aren’t all the signs of fake investor stocks and sites, but they show the trends being used by scammers that you need to be wary of. As an investor, you should be watching for these signs of investment scams.

Do your own research on investment scams

If you see or hear about bond opportunities from any companies, comparison sites, or even friends and family, it’s important to do your own digging before investing in the offer.

Check the company’s official website and speak to the investors directly. If the person who originally contacted you isn’t available, speak to someone else in the investment department to confirm the offer you’ve been told about.

You should also take a close look at the website’s disclaimers and terms and conditions. It may seem like a lot of effort when looking into investment opportunities, but better to be safe than sorry when investing.

We’re on the case of identifying fake investment offers

We know what fraudsters are doing and we’re working hard to combat these scam criminals. We’ve already identified 25+ sites which we’ve taken action against — or are in the process of stopping the investment scheme.

Unfortunately, as we take action, the fraudsters very quickly set up new scam sites that are easy to fall victim to. So it’s important that you stay vigilant and know what to look out for when dealing with scams, investment fraud, and fake sites. For more on how to protect your money and financial accounts, see how to avoid being scammed.

If you come across a website which includes ‘Aviva’ but suspect something’s not quite right or that it is a scam, it’s best to trust your gut. You can report it to us and we’ll investigate it right away.

Contacted by a fraudster or fallen victim to an investing scam?

Click here to report to us right away. We'll take it from here and let you know what you need to do to stay safe.

Real-life examples from investment fraudsters posing as Aviva Canada