Aviva plc Q1 2024 Trading Update

May 23, 2024 (London, UK) – To read this update in full, click here.

Excellent first quarter results

Strong growth across the Group. Another quarter of consistent delivery

Capital position strong and resilient

Amanda Blanc, Group Chief Executive Officer, said:

“This is another set of excellent results, extending our track record of consistently strong trading. Our diversified business model is continuing to deliver, and we are growing right across the Group.

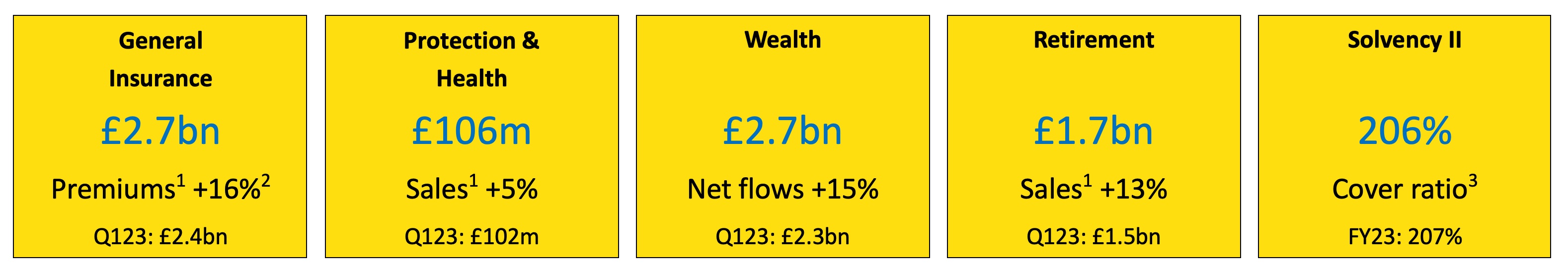

“We accelerated new business sales in our capital-light businesses: General Insurance premiums increased 16% to £2.7bn and our workplace pensions business generated net flows of £2bn as we won 136 new schemes. The bulk purchase annuity market also continues to be active, with Retirement sales up 13%.

“Aviva is in great health. We are financially strong, we are trading well, and our investments in new products and customer service are paying off. We have clear competitive advantages - in our brand, our scale, and our diverse business - which are driving consistently strong performance, and giving us real optimism about 2024.”

Continued capital-light growth momentum

- General Insurance premiums up 16%2 to £2.7bn.

- UK GI premiums up 19% to £1.7bn with 27% growth in personal lines reflecting continued strong rate discipline in the high inflationary environment, and new business growth. Commercial lines grew 10%.

- Canada GI premiums up 11%2 to £0.9bn with personal lines up 16%2 driven by rating actions on the existing book and new business growth. Commercial lines grew 5%2.

- Group undiscounted combined operating ratio (COR) of 95.8% (Q123: 95.4%). An improvement in the UK COR as the rating actions taken earn through was offset by an increased Canadian COR. Discounted COR of 92.0%.

- Protection & Health sales were up 5%, driven by continued growth in Protection.

- Wealth net flows of £2.7bn were up 15% on the prior year with double-digit growth in Workplace, up 13%, and in Platform up 24%.

- Retirement sales were up 13% driven by higher BPA volumes. Retirement margin improved to 2.9% (Q123: 1.9%) as we focused on pricing discipline.

- Estimated Solvency II shareholder cover ratio remains strong at 206%.

- The reduction in the quarter of 1pp was primarily driven by the final dividend, share buyback and the acquisition of Optiom, partly offset by total capital generation in the quarter and completion of the sale of Singapore.

- Solvency II debt leverage ratio of 30.9% (FY23: 30.7%) or 28.7% when allowing for the Tier 2 notes redemption announced on 16 May.

- Centre liquidity (Apr 24) of £2.1bn (Feb 24: £1.9bn), primarily reflecting net proceeds from acquisitions and disposals offset by the share buyback.

- £300m share buyback is progressing well.

- The 2023 final dividend of 22.3p per share was paid to shareholders today.

Progress on inorganic execution

- We continue to make progress in executing strategic deals that enhance value for shareholders. Our focus is on enhancing capabilities or where there are clear financial or strategic benefits to a transaction.

- On 5 January we completed the acquisition of Optiom O2 Holdings in Canada for £100m. The acquisition supports Aviva’s capital-light growth in the attractive Canadian market and strengthens Aviva Canada’s specialty lines business and distribution capabilities.

- We announced the £242m acquisition of Probitas on 4 March: a high quality, fully-integrated platform in the Lloyd’s market, which will expand the market opportunity for Aviva’s Global Corporate & Specialty (GCS) business. The transaction is expected to complete in mid-20244.

- On 18 March we completed the exit from our Singapore joint venture for a total consideration of £937m, further simplifying the Group’s geographic footprint.

- We completed the acquisition of AIG’s UK protection business for £453m on 9 April, accelerating growth in the attractive UK protection market. The acquisition will broaden distribution, with over 2.5m customers across individual and group protection, and deliver capital and expense synergies.

Confident outlook

- We remain confident in meeting the Group targets outlined at our FY 2023 results presentation:

- Operating profit5: £2bn by 2026.

- Solvency II own funds generation: £1.8bn by 2026.

- Cash remittances: > £5.8bn cumulative 2024-2026.

- In General Insurance we remain focused on pricing appropriately. We expect the underlying COR6 to continue to benefit from rating actions taken in 2023 and so far in 2024.

- We expect further strong demand given supportive market dynamics in Protection, and in Health, as set out at our ‘In Focus’ briefing last month. Wealth is central to our strategy and presents a significant opportunity for Aviva to continue to generate sustainable, capital-light growth. We expect to continue our disciplined approach to BPAs.

- We are committed to delivering for our shareholders. As announced with our full year results, our upgraded dividend guidance is for mid-single digit7 growth in the cash cost. Our intentions for further regular and sustainable returns of capital remain unchanged.

Footnotes

- Sales for Protection & Health (Insurance) refers to Annual Premium Equivalent (APE). Sales for Retirement (Annuities and Equity Release) refers to Present Value of New Business Premiums (PVNBP). Premiums for General insurance refer to gross written premiums (GWP). The first instance of each reference has been footnoted. However, this footnote applies to all such references in this Trading Update. APE, PVNBP and GWP are Alternative Performance Measures (APMs) and further information can be found in the 'Other information' section of the Aviva plc Annual Report and Accounts 2023.

- In constant currency.

- Solvency II cover ratio is the estimated Solvency II shareholder cover ratio at 31 March 2024.

- Completion of this transaction is subject to customary closing conditions, including regulatory approvals.

- Reference to operating profit represents Group adjusted operating profit which is a non-GAAP APM and is not bound by the requirements of IFRS. Further details of this measure are included in the 'Other information' section of the Aviva plc Annual Report and Accounts 2023.

- Undiscounted COR excluding the impacts of prior year development and weather versus long term average (LTA).

- Estimated dividends are for guidance and are subject to change. The Board has not approved or made any decision to pay any dividend in respect of any future period.

Media Contact:

Hazel Tan

Email: hazel.tan@aviva.com

Tel: 437-215-5770

About Aviva Canada

Aviva Canada is one of the leading property and casualty insurance groups in the country, providing home, automobile, lifestyle, and business insurance to 2.5 million customers coast to coast. A subsidiary of UK-based Aviva plc, we have the financial strength, scale and are a trusted insurance provider globally for more than 325 years.

For more information, visit aviva.ca or Aviva Canada’s blog, LinkedIn and Instagram pages.