Aviva plc In Focus and Q3 2025 Trading Update

November 13, 2025 (London, UK) – To read this update in full, click here.

On track to achieve 2026 Group targets one year early

Announcing raised ambitions with new three-year Group targets

Announcing upgraded cost synergies and quantifying capital synergies from Direct Line acquisition

Amanda Blanc, Group Chief Executive Officer, said:

“Over the last five years we have transformed Aviva, delivering again and again for our customers and shareholders. We continue to make excellent progress and now expect to achieve our financial targets in 2025, one year early. Crucially, we have achieved this significant milestone thanks to the consistently strong performance of Aviva, before any impacts of the Direct Line acquisition are included.

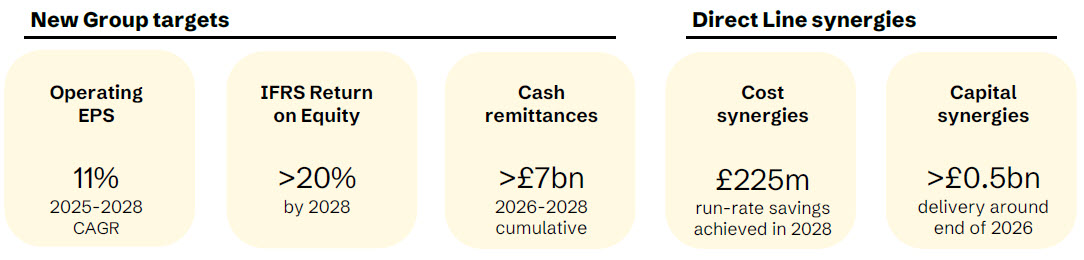

“The integration of Direct Line is well underway and we are increasingly confident of reaping the full benefits of this acquisition, contributing materially to Aviva's future growth and shareholder returns. We now expect to achieve £225 million in cost synergies, nearly twice our original estimate; unlock at least £500 million of capital synergies, and we expect to resume share buybacks next year, at a higher level in response to the increased share count.

“Our third quarter numbers show that once again we are growing profitably right across the group. In general insurance, premiums are up 12% to £10 billion, and in Wealth, we secured net flows of £8.3 billion, and now have £224 billion of assets. We are accelerating our growth in capital-light areas, in line with our strategy, and now expect our business to be over 75% capital-light by the end of 2028. This is good news for shareholders, as we deliver stronger growth and better returns, using less capital.

“The outlook for Aviva has never been better. The advantages of our diversified business, 25 million strong customer base, and majority capital-light earnings, mean we expect to deliver more and more for our shareholders and customers. And so today we are also setting new financial targets, raising our ambitions yet again, and reflecting the strength of our confidence in the continuing growth potential of Aviva."

On track to achieve 2026 Group targets one year early

- Expecting to deliver £2bn operating profit and £1.8bn SII Operating Own Funds Generation targets one year early, driven by exceptional performance across the Group and before any Direct Line contribution. We expect full year 2025 Group operating profit to be ~£2.2bn, including ~£0.15bn from Direct Line.

- Existing >£5.8bn cumulative cash remittances three-year target (2024-26) comfortably on track, with £3.0bn delivered within the first 18 months since setting the target.

Upgrading cost synergies and quantifying capital synergies from Direct Line acquisition

- Direct Line’s £100m original cost reduction programme completed, three months ahead of plan.

- Raising cost synergy ambition to £225m, incremental to the completed Direct Line £100m cost programme. We anticipate total costs to achieve of ~£350m.

- Cost synergies run-rate savings expected to be fully achieved in 20281 with ~£40m expected to be achieved by year end 2025.

- Announcing >£0.5bn of capital synergies which would improve the current solvency ratio position by >10pp, upon regulatory approval expected around the end of 2026, with implementation costs of ~£50m.

- Expect to deliver >£50m run-rate reduction in cost of claims with investment cost of ~£50m.

Raising ambitions with new three-year Group targets, reflecting Aviva now and going forward

- Operating earnings per share (EPS): 11% 2025-2028 CAGR.

- IFRS Return on Equity (RoE): expecting to deliver ~17% in 2025 and targeting >20% by 2028.

- Cash remittances: >£7bn cumulative between 2026 and 2028.

Another quarter of delivery

- General Insurance premiums2 up 12%3 to £10.0bn (9M24: £9.1bn).

- UK&I GI premiums up 17% to £6.7bn (9M24: £5.7bn) with 24% growth in Personal Lines, reflecting the acquisition of Direct Line as well as growth in partnerships, and 10% growth in Commercial Lines driven by Probitas and new business growth.

- Canada GI premiums up 3% in constant currency to £3.3bn (9M24: £3.4bn) with Personal Lines up 7% supported by favourable pricing increases, and Commercial Lines 4% lower following the exit of some unprofitable accounts in H1.

- Group undiscounted combined operating ratio (COR) of 94.4% (9M24: 96.8%), benefitting from strong price adequacy and improved weather-related losses, reflecting the severe weather in Q324 in Canada. Discounted COR of 90.4% (9M24: 92.8%).

- Wealth net flows of £8.3bn (9M24: £7.7bn) represented 6% of opening Assets Under Management (‘AUM’)4 with strong growth in Platform and Workplace net flows.

- Protection and Health sales2 of £384m were 5% lower (9M24: £403m) due to the consolidation of propositions following acquisition from AIG, while margins continue to improve. Health in-force premiums were up 14% driven by new business growth and pricing actions.

- Retirement sales of £5.3bn (9M24: £7.3bn) were strong despite being lower than a particularly elevated prior year, with 9M25 BPA volumes of £3.9bn (9M24: £6.1bn). Individual Annuity and Equity Release sales were up 24% and 39% respectively.

- Aviva Investors external net flows of £0.7bn were 18% higher than the prior year driven by strong net inflows into multi-asset funds and strong inflows on one large account. Total net flows improved materially to £(19)m (Q324: £(1,716)m).

Strong solvency and liquidity positions

- Estimated Solvency II shareholder cover ratio of 177% (HY25: 206%), in-line with our previous guidance, following the completion of the Direct Line acquisition, and excludes >£0.5bn of capital synergies expected around the end of 2026.

- We expect the FY25 Solvency II shareholder cover ratio to be broadly consistent with Q325, subject to market movements.

- Solvency II debt leverage ratio of 31.4%, pro forma for the announced call of the €900m Tier 2 instrument in December 2025 (HY25 Solvency II debt leverage ratio of 32.3%).

- Centre liquidity as at the end of October 2025 of £2.2bn (July 2025: £2.1bn).

Confident outlook

- We expect full year 2025 Group operating profit to be ~£2.2bn, which includes six months of Direct Line operating profit of ~£0.15bn.

- In General Insurance, we have observed areas of rate softening in the first nine months but remain focused on pricing appropriately to maintain strong pricing adequacy across the portfolio. We continue to monitor the market conditions and flex our trading approach to maintain profitability.

- In Wealth, we expect strong growth momentum underpinned by our Workplace business which continues to see £1bn of inflows from regular member contributions each month. We remain on track to meet our ambition for £280m operating profit by 2027.

- In our Health business, we anticipate further growth towards our 2026 ambition of £100m operating profit. In Protection we expect the sales decline observed in the first nine months to further moderate as the consolidation of propositions occurred in August 2024.

- In BPA, we will continue to remain active but disciplined, and have written volumes of ~£4.5bn including preferred provider as of today, but do not expect this to increase materially before the end of the year. The pipeline remains robust into 2026.

- Our guidance for shareholder distributions5 remains unchanged. We increased the 2025 interim dividend by 10% representing both our usual mid-single digit dividend increase as well as a further mid-single digit uplift following the completion of the Direct Line transaction. We expect the approach to the 2025 final dividend to be consistent with this.

- From 2026 onwards, our guidance for mid-single digit growth in the cash cost of the dividend remains. We expect to reintroduce regular and sustainable returns of capital alongside our full year 2025 results in March 2026, increased to reflect the 14% higher share count following completion of the Direct Line acquisition.

[ends]

Footnotes

1 Cost synergies to be fully embedded in 2029.

2 Sales for Insurance (Protection and Health) refers to Annual Premium Equivalent (APE). Sales for Retirement (Annuities and Equity Release) refers to Present Value of New Business Premiums (PVNBP). Premiums for General insurance refer to gross written premiums (GWP). The first instance of each reference has been footnoted. However, this footnote applies to all such references in this announcement. PVNBP, APE and GWP are Alternative Performance Measures (APMs) and further information can be found in the 'Other information' section of the Aviva plc Half Year Report 2025.

3 All GWP movements are quoted in constant currency unless otherwise stated.

4 All net flows as a percentage of opening assets under management are annualised.

5 The Board has not approved or made any decision to pay any dividend or initiate any buybacks in respect of any future period.

Media Contact:

Hazel Tan

Email: media@aviva.com

About Aviva Canada

Aviva Canada is one of the leading property and casualty insurance groups in the country, providing home, automobile, lifestyle, and business insurance to 2.5 million customers coast to coast. A subsidiary of UK-based Aviva plc, we have the financial strength, scale and are a trusted insurance provider globally for more than 325 years.

For more information, visit aviva.ca or Aviva Canada’s blog, LinkedIn, and Instagram pages.