Nearly 70% of commercial buildings are underinsured by an average of 30%. At Aviva, we see that roughly half of ourpolicyholders with property and business interruption insurance suffering larger losses have underestimated insured values.

Failing to set the right values for commercial buildings, equipment, and loss limits could cost enterprises millions of dollars in the event of a large loss.

High on the list of priorities for risk managers should be an annual review of their insurance policy. This is typically done with a broker advisor. Here’s a list of considerations to bring to the discussion.

Building replacement cost

Building replacement cost refers to the estimated expense of rebuilding a structure from scratch using similar materials, construction standards and quality at current market prices. It’s a fundamental concept in property insurance, used to determine the appropriate amount of coverage for a building.

However, commercial policyholders often undervalue the true cost of replacing a building after a loss. Commonly overlooked costs include:

- razing a partially destroyed building before construction can begin

- engineering explorations to ensure the structural integrity of the rebuild

- special removal process for hazardous materials such as lead plumbing or asbestos

- bringing contractors and materials in on an accelerated timeline.

Equipment

It’s important to consider the replacement cost of the equipment within the property as opposed to the depreciated value of it. At Aviva, we see a lot of gaps in this area.

For example, if a business owns an older, niche piece of equipment such as a punch press, they may value it based on what it’s worth to sell. But, in the event of a large loss, the company would need to replace it with a newer model, so they need to be insured for what that would cost in today’s market. Even if it can be purchased used, there may still be high costs associated with shipping.

Inventory

The type of inventory plays a significant role in determining its value. Finished goods are usually valued at their market price or production cost, raw materials are assessed based on current purchase costs, and work-in-progress inventory is valued according to the production costs incurred up to the point of loss.

Additional factors, such as inflation and market trends, should also be considered when valuing inventory. Rising costs of goods and materials can significantly impact replacement values, and policy values should account for these changes through periodic adjustments.

Similarly, transportation and storage costs for replacing inventory post-loss, as well as the time it may take to replace specific items with long lead times, can influence the required level of coverage.

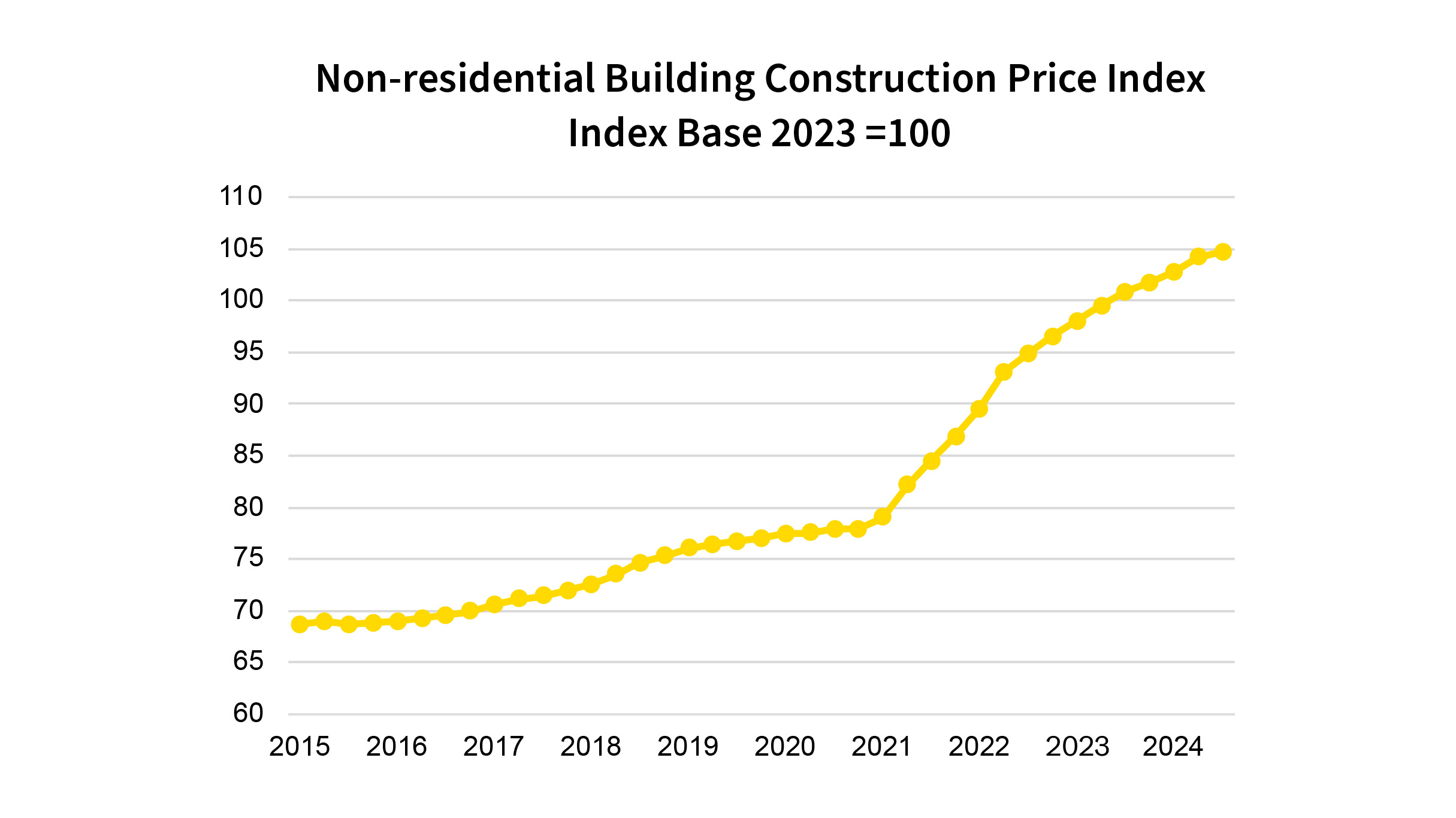

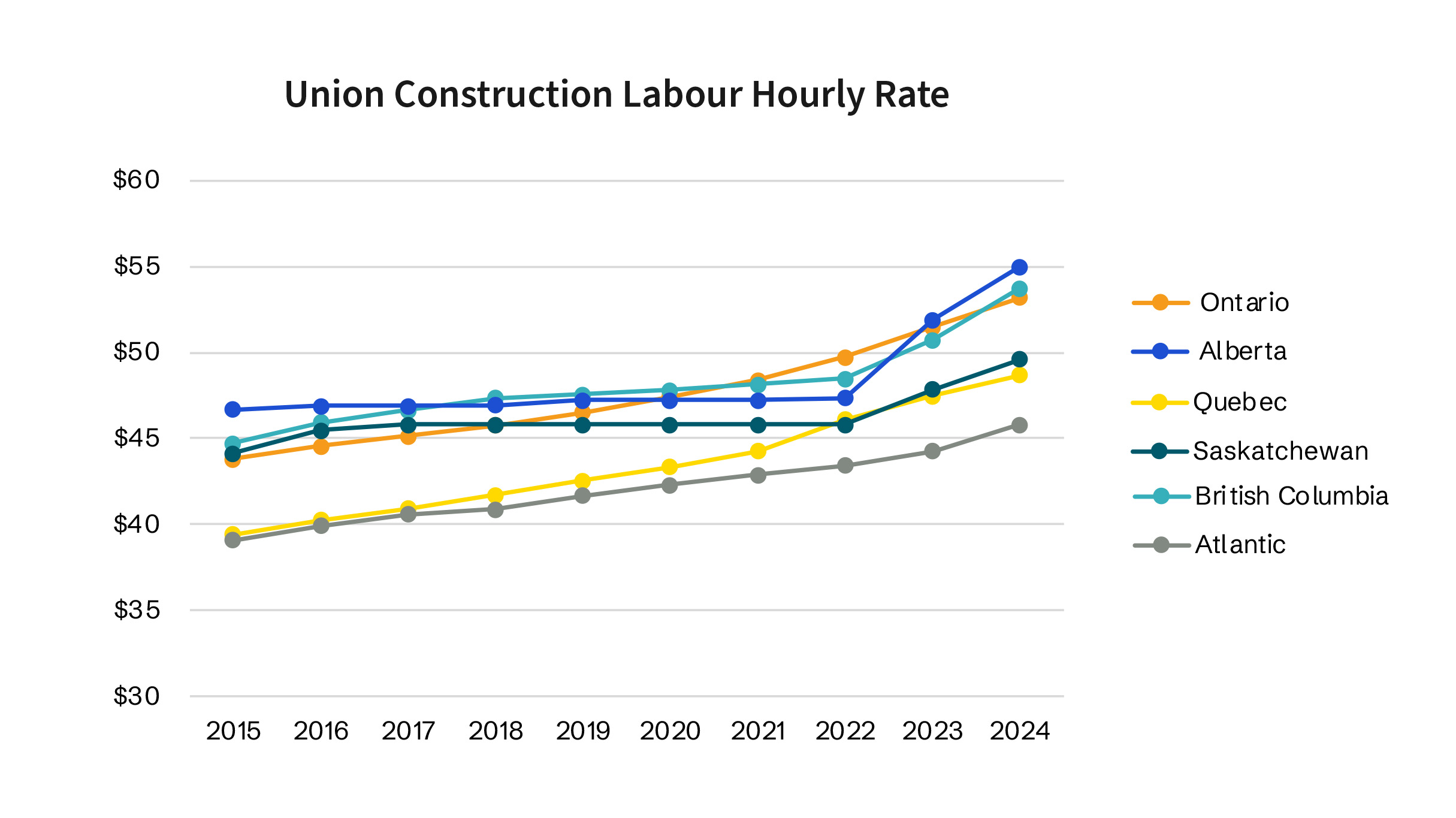

Inflation

One of the reasons it’s important to review and update commercial property policies every year is the impact of inflation. Most values should be increased in the region of 3-5% every year to keep pace with real market costs.

Building bylaws

Municipal regulations can significantly affect the cost of rebuilding or repairing a damaged property. Many bylaws require properties to comply with updated building codes, safety standards, or zoning laws when they are being rebuilt or repaired.

These regulations may include requirements for upgraded electrical systems, structural changes, or additional safety features that were not necessary when the building was originally constructed.

It's important to factor in these potential costs when setting loss limits and considering replacement values. Standard property insurance policies typically cover the cost of replacing a building to its pre-loss condition but may not include the added expenses associated with compliance to new bylaws.

Distant locations

Buildings located in the far north or other remote locations need to consider the cost of accessing and transporting materials and establishing a workforce to address a loss. Areas with seasonally accessible roads are particularly vulnerable to delays and additional costs. This needs to be factored into loss limits or replacement cost valuations.

Review your policy every year

Once property and business interruption values have been correctly set, it’s important to review and update your policy annually, because the impacts of inflation, materials and labour costs continue to rise. At every renewal process, take the time to evaluate each of these factors and integrate updated values.

In next quarter’s newsletter, we will provide useful pointers on correctly setting business interruption values and indemnity periods with a focus on dependencies and contingent exposures.

Contact us for more information

Aviva Risk Management Solutions has professional risk consultants across Canada who can provide expert advice and resources. Reach out to arms.canada@aviva.com.