The mining industry has a lot to teach us about the impact of changing trade sanctions on supply chains—and how to mitigate these risks.

Pascal Tremblay, Senior Risk Specialist for Aviva Risk Management Solutions (ARMS) shared strategies and solutions for risk managers at the 2025 RIMS Canada conference. Here are some key insights all businesses can learn from.

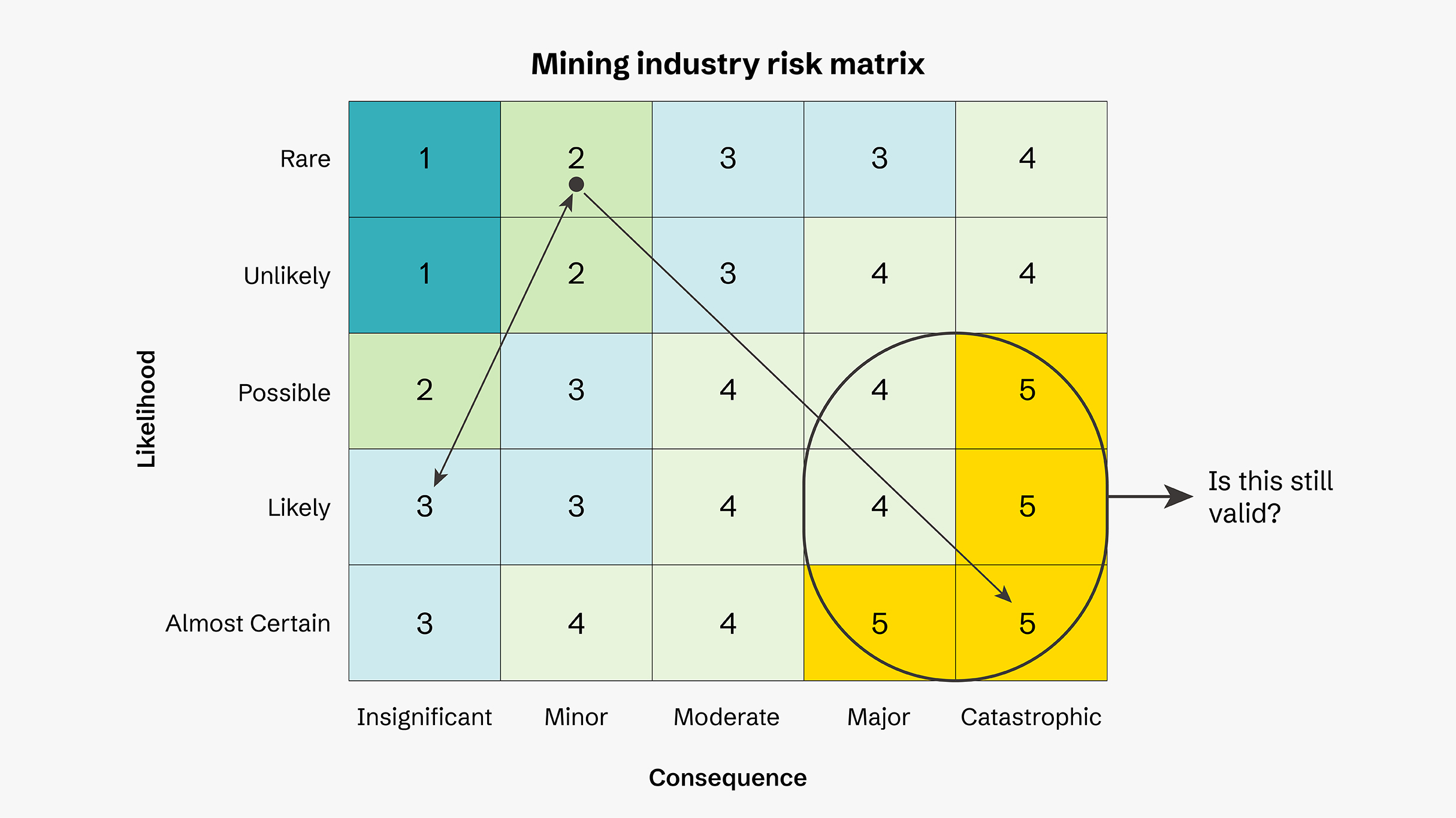

Maintaining a current risk matrix is critical

Like many industries, mining organizations experience both forecasted and unforeseeable events that cause disruptions, including labour shortages, supply chain delays, increased costs, and new regulatory requirements. Each new hurdle gives rise to an evolving risk perception. It’s important to constantly reassess risk tolerance thresholds.

“Risk managers must constantly adapt their frameworks to stay ahead. Exposures that were once categorized as acceptable may come to pose a significant threat,” said Tremblay.

Considerations should include access to equipment and supplies, current market conditions, supply chain vulnerabilities, and geopolitical developments.

Strategies to mitigate business interruption and risk management

An evolving risk environment demands strategic evaluation and adjustments. Tremblay advises risk managers to:

- Assess supply chain risks: Evaluate supply chain dependencies and vulnerabilities to create tailored risk management strategies.

- Revisit critical supplier lists and networks: Update and expand the network of approved suppliers for critical equipment.

- Review spare parts inventory: Assess inventory levels for critical components and consumables.

- Extend lead time assumptions in project planning: Adjust procurement timelines to reflect potential sourcing delays.

- Validate contingency plans: Ensure business continuity plans are updated to reflect current supply chain risks.

Contingency planning a cornerstone of organizational resilience

Companies willing to open new doors, adapt their sourcing strategies, and move quickly to diversify will be best positioned to maintain operational resilience in the face of growing global uncertainty.

Considerations include being aware of:

- Supply chain: Key suppliers, alternatives, critical lead times

- Clients and partners: Potential impacts, proactive communication

- Global context: Conflicts, pandemics, extreme weather events

Tremblay also recommends annual table-top exercises that provide realistic simulations to test coordination, response speed, and plan effectiveness.

Establishing positive risk manager and site dynamics

Risk managers and on-site staff are part of the same organization but often have differing day-to-day realities. Tremblay says it’s important to understand any potential conflicts and address them head-on.

“There’s often a gap between strategic vision and operational constraints. Local sites are under pressure to increase production and may feel that head office doesn’t fully address their needs,” he said.

“Regular site visits help build trust and understanding. We advise risk managers to treat local sites like strategic business clients.”

Another benefit of good communication and resilient relationships is that they encourage faster problem reporting—and faster reporting enables quicker insurance resolutions or capital responses.

Real-time tariff risk management

Proactive tariff monitoring and scenario modeling can help mitigate major disruptions and support agile decision-making. Tremblay shared a system that one mining company created to improve pricing clarity.

Automated impact assessment: A system processes all new tariff announcements and estimates their financial impact across individual sites and the company as a whole.

“This was embedded into the company’s accounting system to help them understand how and where tariffs would impact them across their operations,” said Tremblay.

“Some of the large accounting firms are offering this type of system to help companies better track the impact of tariffs.”

Transparent cost tracking: Instead of adjusting the base price of goods, tariffs are recorded as a separate line item in the supply chain system—ensuring clarity and traceability.

“The same mining company instituted this system to ensure prices weren’t being changed as a result of tariffs. By integrating this into their accounting system, they are able to capture all of the tariffs and see the financial impact at a glance.”

Tariffs and market redirection

No matter what the industry, high tariffs can make certain markets less attractive. Companies need to be prepared to redirect sales to other regions.

While this might be positive for an individual company, it can reduce material availability in the original market. For example, heavy mobile equipment manufacturers have been facing cost increases due to supply chain shortages and delays. Risk managers should anticipate how tariff changes can alter market access and material availability, and integrate this into their operation’s resilience planning.

Adapting to evolving global trade dynamics and supply chain uncertainty requires a fundamental shift toward proactive operational resilience. The mining sector's experience underscores that survival hinges on nurturing strong, communicative relationships between strategic risk managers and on-site operations and integrating sophisticated tools for real-time risk assessment.

By committing to a culture of continuous planning, diversification of supplier networks, and transparent financial tracking, businesses can transform external pressures from crippling threats into manageable challenges, ultimately securing continuity and a competitive advantage in a volatile market.