As operational risks demand smarter mitigation strategies, telematics and dash cameras have emerged as critical tools to maintain commercial fleet efficiency and safety, and compliance.

Andrew Stacey, Commercial Fleet Risk Specialist for Aviva Canada, delivered a presentation on this fundamental shift at the RIMS Canada 2025 conference, emphasizing the power of real-time data in transforming both fleet management and insurance coverage.

Telematics: The new operational nerve centre

Telematics integrates telecommunications and data analytics, providing a real-time stream of information on a vehicle's performance, movement, and driver behaviour. Data from sensors and computer systems is transmitted wirelessly to the cloud or an SD card.

This technology is applicable across virtually every sector operating commercial vehicles: trucking, marine, service and utilities, fire services, rail, police, aviation, EMS, public transit, and food delivery.

Telematics systems capture detailed data that supports operations, compliance, and safety:

- Operational monitoring includes GPS for navigation, engine health, fuel monitoring, EV battery status and health, CO2 carbon tracking, and adaptive cruise control.

- Compliance features monitor drivers’ daily hours of service, alert drivers and fleet safety managers to pending violations, and provide IFTA reporting.

- Maintenance includes diagnostic alerts of mechanical failure and supports preventive maintenance planning.

- Security information such as geofencing, panic buttons, and unauthorized movement detection.

- Extended applications cover environment (temperature monitoring), and environmental tracking (emissions and idle time reporting).

Although the benefits that a telematics system can provide are irrefutable, Stacey says the challenge for many companies is committing to managing and using the data.

“The hard work comes in processing and acting on the data,” he said.

“The key is not to oversaturate yourself. Look at the quick wins like identifying driver behaviour trends (harsh braking, speeding, harsh acceleration) and use score cards so drivers know where they stand in the system. Recognize the drivers who are doing well. That goes a long way.”

Dash cameras: The objective eyewitness

Dash cameras, often using AI technology, provide objective evidence that is crucial for accurate risk assessment and incident resolution.

Forward-facing cameras are mounted to capture real-time video of the road ahead, recording events like collisions, near misses, and harsh braking, often overlaid with GPS and speed data. This is invaluable for objective incident review and driver exoneration.

Driver-facing cameras monitor the driver inside the vehicle, tracking behaviours such as distraction and fatigue. Their AI capability can detect unsafe actions like phone use, enabling targeted in-cab coaching, and improving driver accountability.

“Dash cams are handy for driver coaching. If you’re following too close to the car in front of you, you’ll get an audio alert. If you’re going over the speed limit, it’s going to tell you you’re going too fast,” said Stacey.

“Another big advantage is that, if there’s an accident, it’s the best witness you’re ever going to get. It cuts down on fraudulent claims.”

Strategic benefits of telematics and dash cameras for fleets and insurance

The data gathered by these tools provides tangible benefits across the business:

- Operational resilience: Telematics delivers improved fleet efficiency through route optimization and real-time traffic data. Operational costs are reduced by lowering fuel consumption and facilitating predictive maintenance.

- Safety and driver behaviour: Continuous monitoring of harsh braking, cornering, speeding, and fatigue improves driver habits, leading to a reduction in collisions and creating predictive data for loss prevention.

- Compliance and reputation: Audit-ready reporting and record-keeping and maintenance strengthens regulatory compliance. A documented commitment to safety enhances customer relationships, builds credibility, and supports environmental sustainability goals.

- Collision investigations: Immediate detection of sudden deceleration or impact triggers automatic footage saving. This video data, combined with GPS location, direction, and speed, is used for accurate timeline reconstruction, liability determination, and supporting insurance claims. Most importantly, the insights gained lead to long-term corrective actions, including policy updates and remedial training.

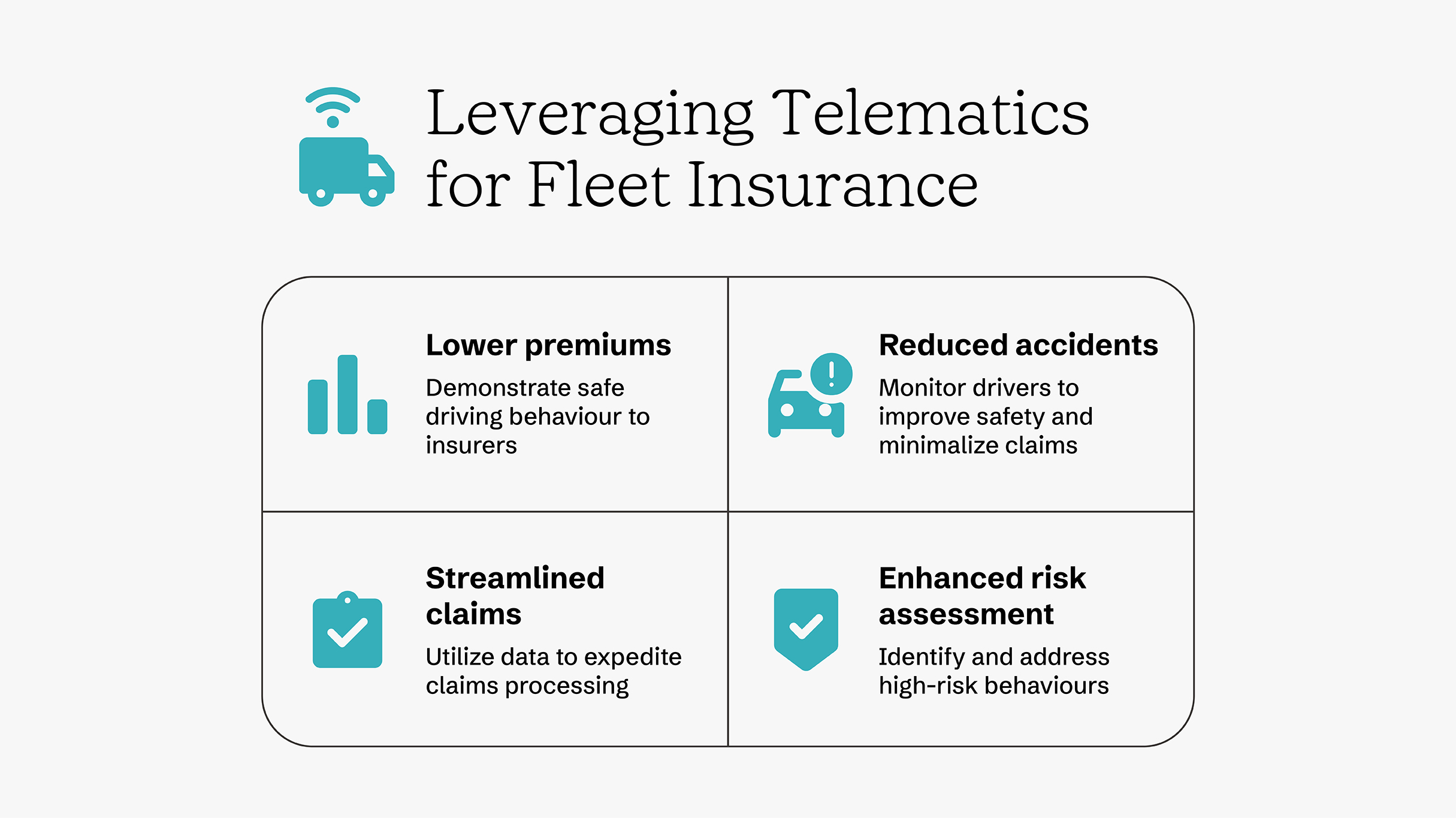

Telematics transforms underwriting

Implementing these technologies demonstrates a company’s proactive focus on risk-based loss prevention.

“There is liability in telematics data and it’s a fleet manager’s responsibility to understand that risk. That’s where it’s important to remember that we’re here to help,” said Stacey.

Aviva Fleet Telematics coverage uses companies’ existing telematics solutions to provide tailored insurance for commercial fleets. Insurance premiums can be affected based on changes to a company’s risk exposure and telematics risk score. If driver behaviour and other risk factors are better than average, according to the telematics data, the company may receive a premium credit. If fleet scores are lower, Aviva’s commercial fleet specialists provide mitigation strategies that could help avoid an additional premium.

“If telematics data shows an alarming trend, we can come in and explain what we’re seeing and provide action points to help reduce them,” said Stacey.

By treating vehicle data as a strategic asset, companies can demonstrate an effective risk profile, securing continuity and making fleet safety a cornerstone of business operations.

“As we move forward, embracing smart fleet technologies is not just a competitive edge—it’s a necessity for safer, more efficient operations,” said Stacey.