About half of the world’s publicly listed mining and mineral exploration companies call Canada home. Many also have operations in 95 foreign countries around the world, including in Mexico, Brazil, Africa, and Australia.

In addition to increased costs due to hefty tariffs on steel and aluminum, the Canadian mining industry is facing significant supply chain disruptions for equipment. Some manufacturers’ products, such as Caterpillar can only be sourced from the US from specialized production facilities. Others must pass through multiple countries in their production and distribution, leaving them subject to increased tariff-related costs and delays.

It’s crucial for Canadian mining companies to understand and proactively manage these supply chain risks to maintain operational continuity and financial stability.

Critical equipment categories affected by tariffs

Several categories of mining equipment are particularly susceptible to supply chain interruptions and cost inflation due to tariffs. They include:

- Electrical infrastructure components: Transformers and industrial generators are critical for powering operations.

- Material processing machinery: Crushers, mills, and conveyors—essential to ore processing—are at risk of delayed delivery and cost increases, jeopardizing production schedules.

- Ventilation and safety systems: Mining ventilation systems are crucial for underground operations; any delay in securing or replacing these systems can present serious safety risks.

- Automation and control systems: Operational efficiency and modernization efforts are compromised due to sourcing challenges for programmable logic controllers (PLCs) and other automation technologies.

- Heavy mobile equipment and components: Extended delivery times or increased costs for essential vehicles and components like mining trucks, loaders, and tires—many of which are manufactured in the United States—could significantly disrupt site operations and mobile fleet availability.

Implications and strategies to mitigate business interruption and risk management

The extended lead times and elevated costs for critical equipment have a direct impact on business continuity. Prolonged downtimes not only threaten production schedules but can also trigger significant financial losses.

For mining operators, this evolving risk environment demands strategic evaluation and adjustments. Consider actions such as:

- Assessing supply chain risks: Evaluate supply chain dependencies and vulnerabilities to create tailored risk management strategies.

- Revisiting critical supplier lists and networks: Update and expand your network of approved suppliers for critical equipment, such as transformers, crushers, heavy mobile machinery, and ventilation systems.

- Reviewing spare parts inventory: Assess inventory levels for critical components and consumables.

- Extending lead time assumptions in project planning: Adjust procurement timelines to reflect potential sourcing delays.

- Validating contingency plans: Ensure business continuity plans are updated to reflect current supply chain risks.

- Reassessing risk tolerance thresholds: Risks previously categorized as acceptable may now pose a significant threat.

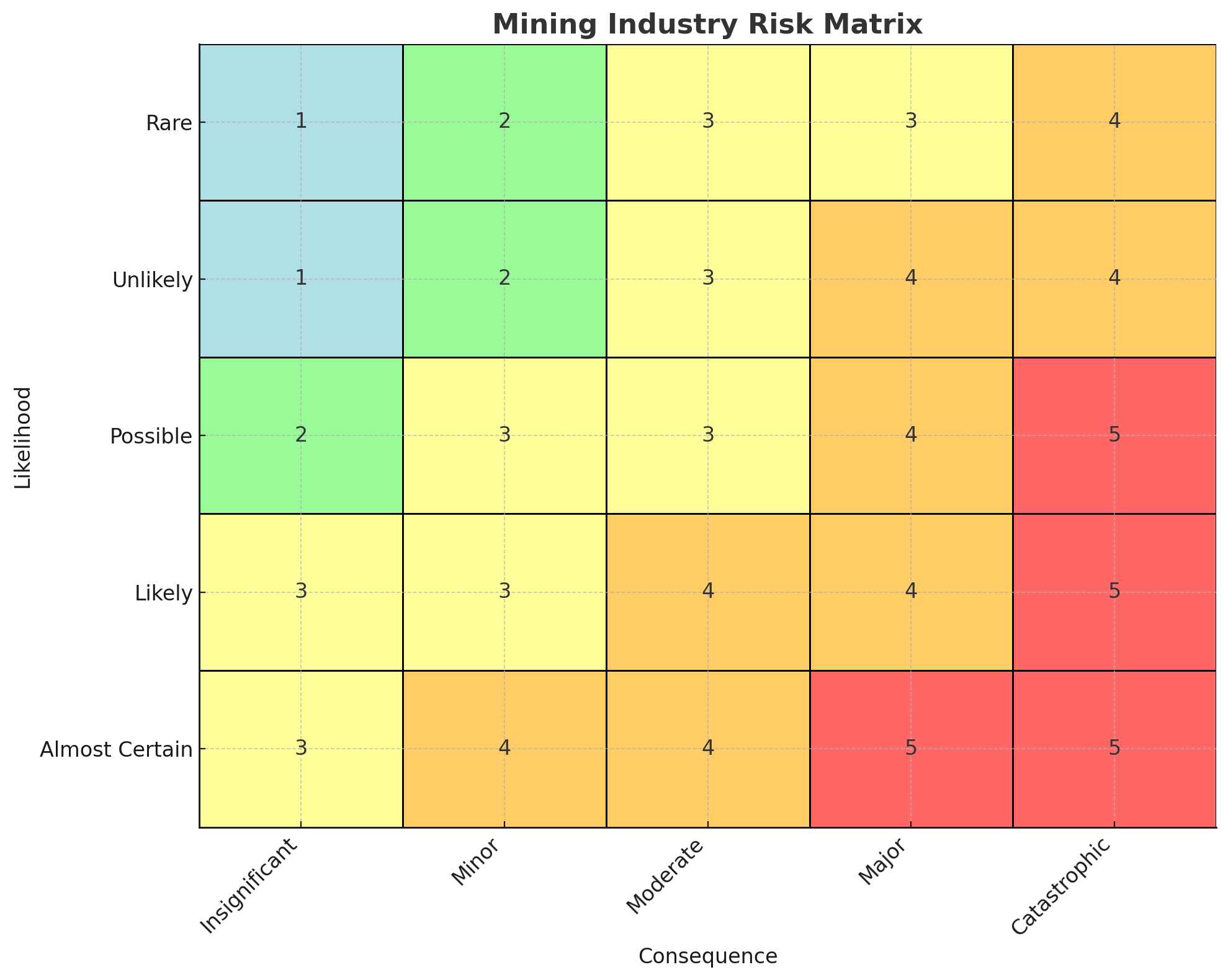

Another important action during uncertain times is to maintain an up-to-date risk matrix. Consider the equipment and supplies you will need and assess current market conditions, supply chain vulnerabilities, and geopolitical developments to determine the risk.

Companies willing to open new doors, adapt their sourcing strategies, and move quickly to diversify will be best positioned to maintain operational resilience in the face of growing global uncertainty.

Aviva Risk Management Solutions is here to help

Our team is here to support the mining sector in navigating these new challenges. Together, we can help you protect your operations, strengthen your resilience, and continue to deliver long-term value in a changing world. Reach out to us at arms.canada@aviva.com.

Sources:

Natural Resources Canada – Canadian mining assets

CIM Magazine – Bracing for impact