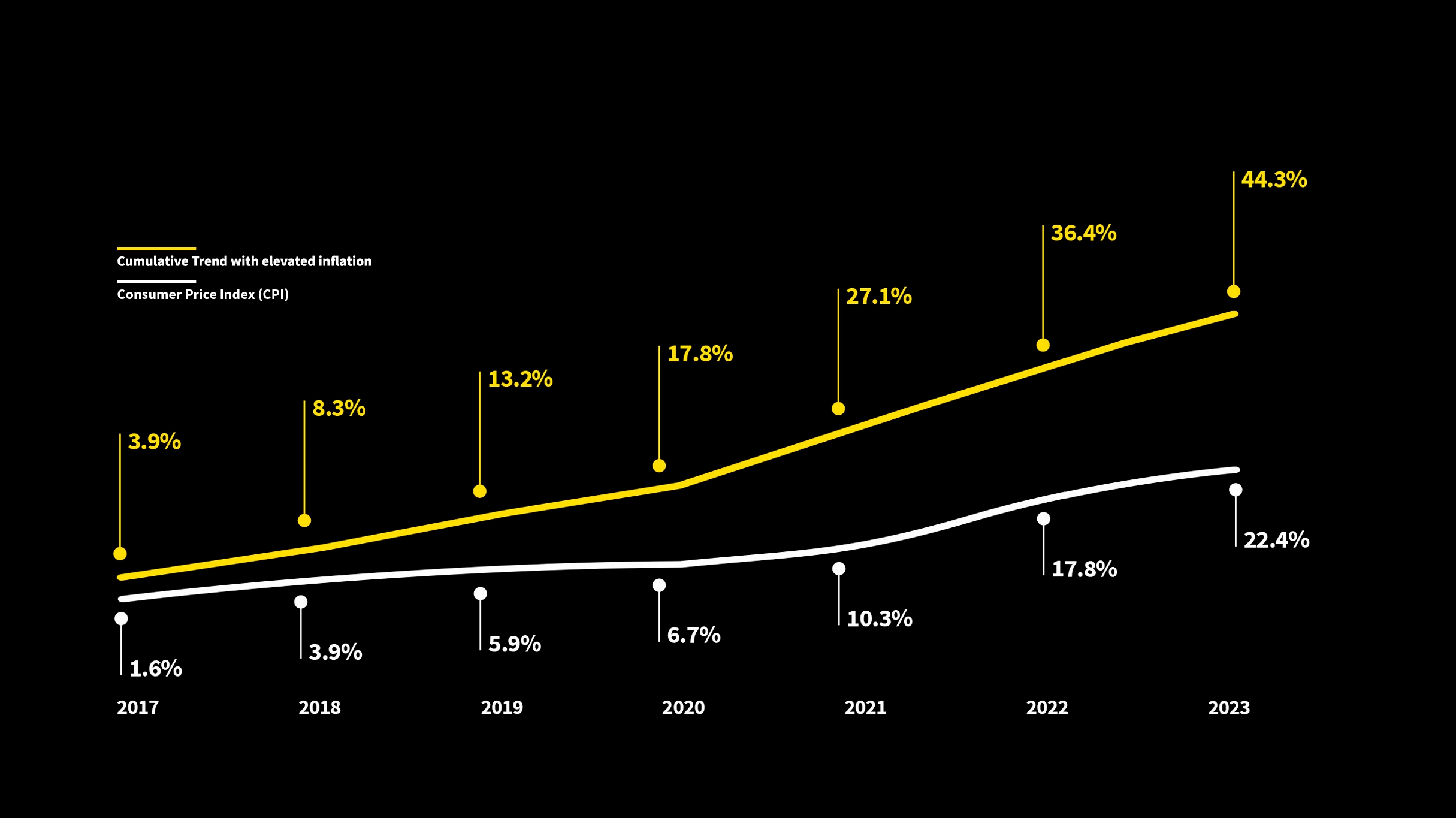

From 2017-2020, we saw a normal progression of cost increases after a loss. Starting in 2021, a steep incline emerged as prices and disruptions shot up and the consumer price index (CPI) rose in response.

Property Loss Trends

The graph below highlights the level of the cumulative property loss trend above and beyond the CPI. Property loss trend was relatively stable until 2020, but saw significant volatility since 2021.

Big impact in property

Cost of building materials

The cost of materials ballooned in 2021 and 2022, including lumber, drywall, roofing supplies, paint and HVAC goods.

- A $1,000,000 claim at the start of 2017 would have skyrocketed to $1,433,000 by the end of 2023.

Casualty and auto losses followed a similar cost trend as property. They also had further reasons for higher costs.

Casualty

Legal representation on the rise

We saw an increase in the number of customers securing legal representation in 2023. When a claimant is represented by a lawyer, 20% to 30% of the indemnity payment is dedicated to their fees and disbursements, on top of damages the claimant received in the accident.

How you can help reduce costs: Notify us of claims as soon as possible so we can immediately reach out to claimants and potentially resolve the claim with them directly.

- In 2023, Aviva paid $1M in additional costs on 152 bodily injury slip and fall claims with claimants that had legal representation.

Auto

High theft rates not the only cost factor

In 2022, auto theft was at an all-time high in Canada, particularly in Ontario, which contributed to increased costs for the insurance industry. Two other significant cost trend factors had a big impact:

1. Challenges with sourcing car parts

2. A decrease in skilled labour

These issues put upward pressure on the cost and time it takes to repair a vehicle. In some cases, this could double our Loss of Use claims and rental uses, increasing the average loss cost of an auto claim.

- In 2019, the average wait time to get into a repair facility was 7 days. In 2023, it was 15 days.

Looking for more information?

Aviva’s Global Corporate & Specialty team would be happy to answer your questions. Contact us at gcs.ca@aviva.com