In the United States, nuclear verdicts that are $10M or higher, led by juries that punish corporate defendants with huge punitive damage awards, are the norm. The landscape is far different in Canada, where we have a more restrictive discovery process.

In addition, the Supreme Court of Canada in 1978 set a $100,000 cap on non-pecuniary (or general damage) awards. Indexed for inflation, that cap now stands at $460,000, keeping nuclear verdicts at bay.

However, there are differences within Canada among provinces. For example, did you know that Newfoundland and Labrador is the only province where the plaintiff doesn’t recover a portion of their legal fees should they choose to sue? It is only after a trial that these become payable, and cases rarely go to trial in that province.

There are other differences among provinces that are worth noting, particularly if you face liability exposure in multiple provinces. Understanding the way claims experiences vary across the country will help you assess the financial exposure for claims falling within a self-insured retention or under your deductible and, ultimately, see why your policy is priced the way It is.

Provincial legislative differences: suing for injuries sustained in an auto accident

Each province has its own legislative framework which impacts whether claimants have a right to sue — and for how much. Private systems typically allow an option to sue, with limits and some no-fault benefits. Public systems offer generous no-fault benefits with no right to sue.

| Manitoba | Pure no-fault | Public: Generous no-fault benefits, no right to sue |

Quebec | Pure no-fault | Public: Generous no-fault benefits, no right to sue |

Saskatchewan | Pure no-fault | Public: Generous no-fault benefits, no right to sue; option to opt out |

| Nova Scotia | Threshold | Private: Cap on recovery for non-pecuniary losses for minor injuries (currently indexed to $10,402); right to sue preserved |

| New Brunswick | Threshold | Private: Cap on recovery for non-pecuniary losses for minor injuries (currently indexed to $9,513.14); right to sue preserved |

| PEI | Threshold | Private: Cap on recovery for non-pecuniary losses for minor injuries (currently indexed to $9,358); right to sue preserved |

| Ontario | Threshold | Private: Verbal threshold and $46,053.20 deductible if assessed at $153,509.39 or less; right to sue preserved |

Deductible | Private: $5,000 deductible only for general damages; right to sue preserved | |

| Alberta | Threshold | Private: Cap on recovery for non-pecuniary losses for minor injuries (currently indexed to $6,061); right to sue preserved |

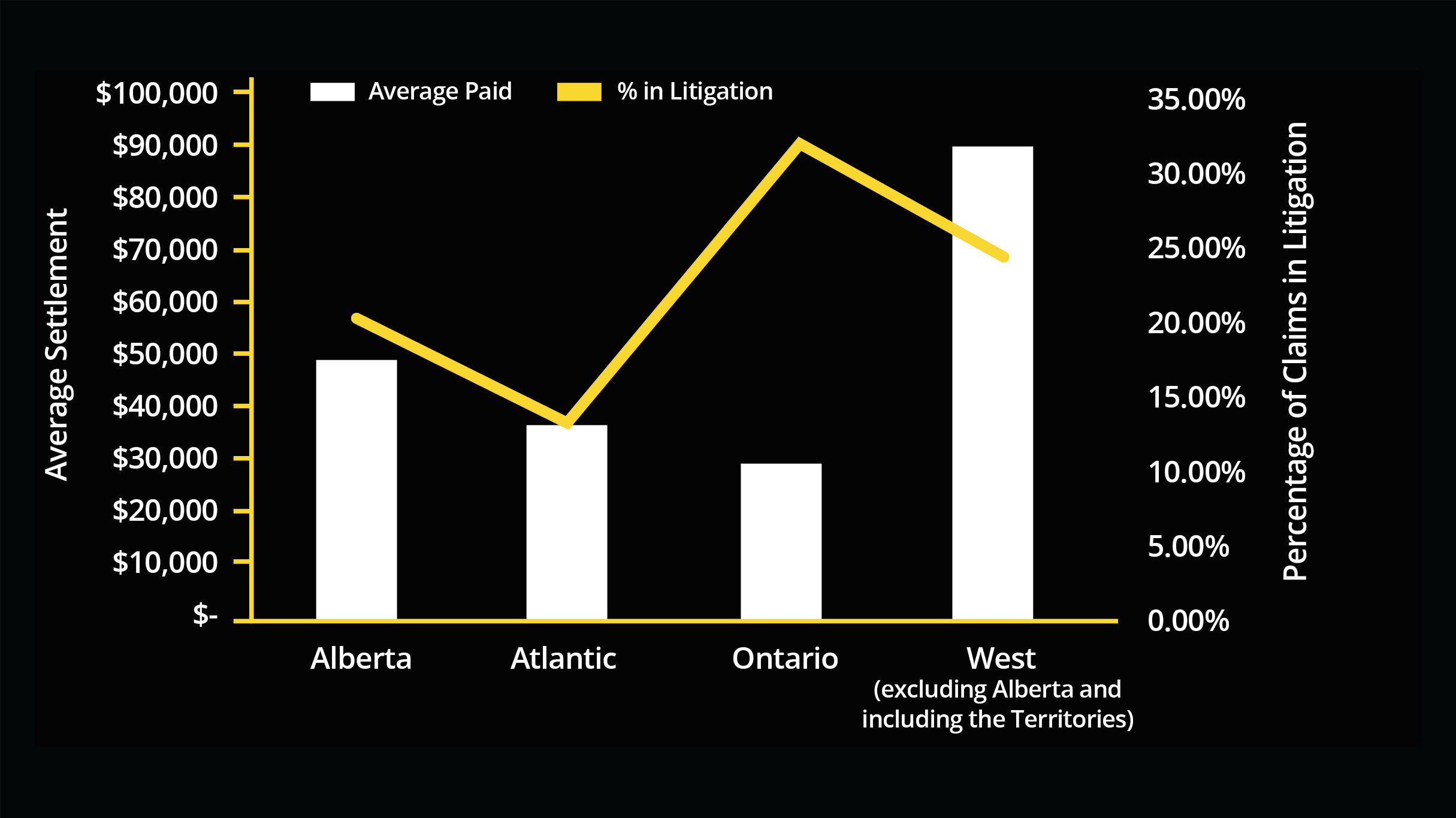

Commercial auto bodily injury outcomes for accidents: 2018-2024

A higher deductible and more restrictive threshold in Ontario keeps the average payout for injuries about 30% lower in that province than in the Atlantic provinces, and 70% lower than Alberta.*

This is despite the fact that Ontario has a higher percentage of claims that settle in litigation. Aviva settled 32% of Ontario claims in litigation vs. 20% in Alberta and 13% in the Atlantic over the same time period.

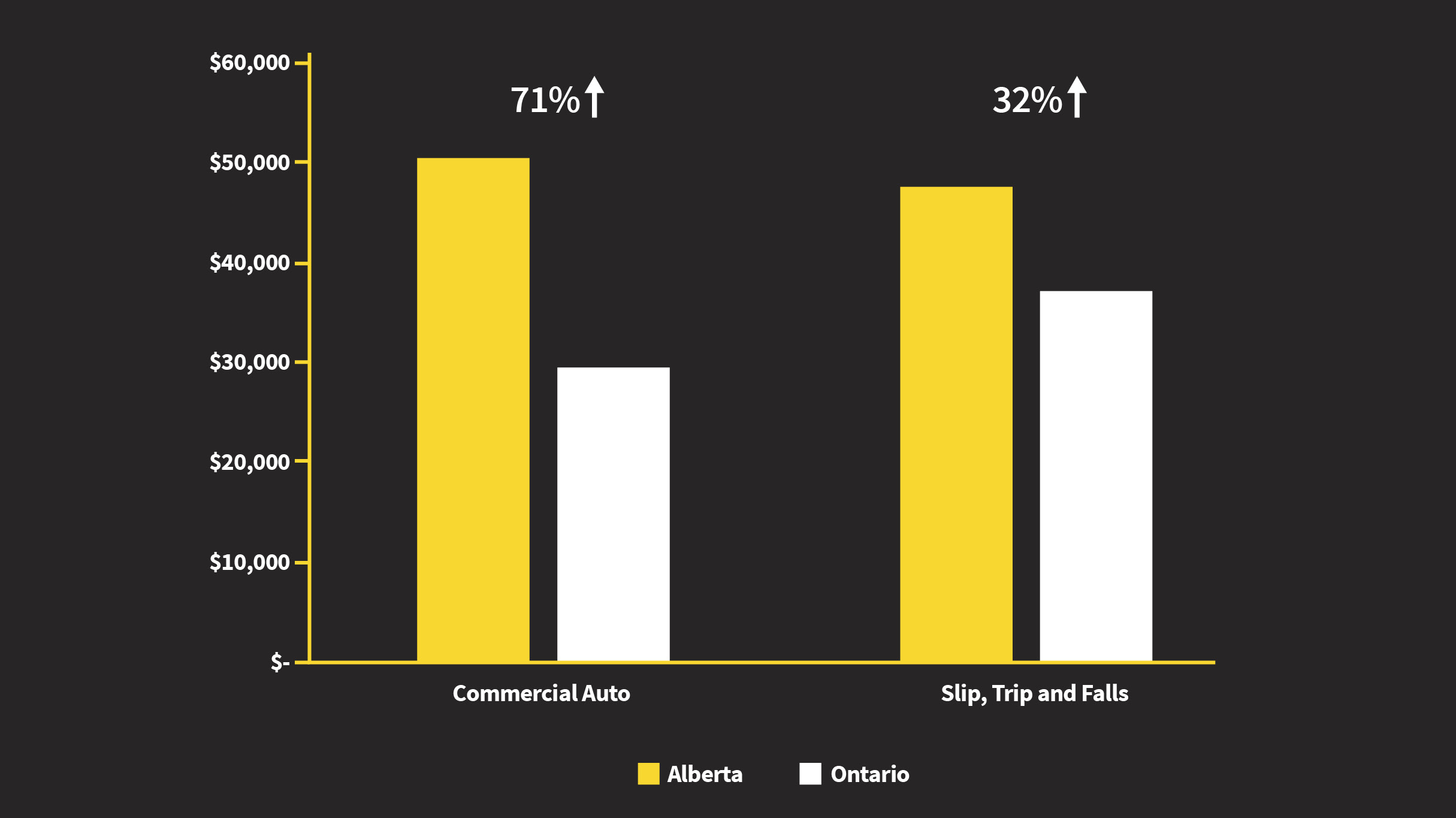

Resolved Alberta and Ontario bodily injury claims for accidents: 2018-2024

There are swings in the average settlements for injuries sustained in slip, trip and fall or other premises-related liability accidents.

Why do we see a higher average settlement in Alberta?

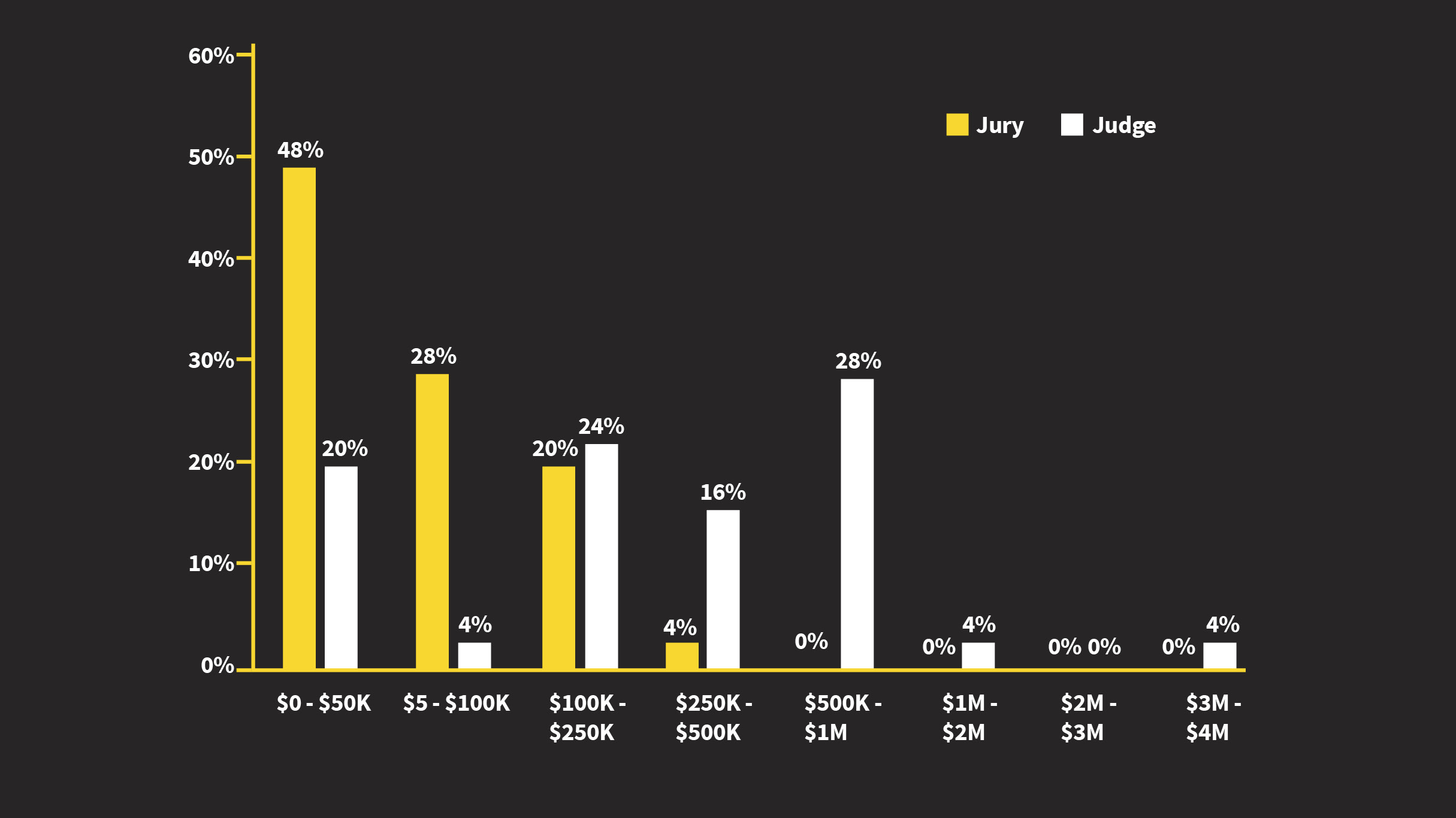

There are a number of factors, but perhaps the single biggest contributor is the fact that jury trials are permitted (and coveted) in Ontario but are rarely allowed in Alberta.

Juries tend to apply more common sense when reviewing liability and damages compared to judges alone and the threat of a jury trial helps to promote more favourable settlements in Ontario.

Ontario bodily injury awards: 2002-2020

A study completed by the Aviva Trial Lawyers in 2021, showed that, on average, judges alone in Ontario awarded $482,361.75 to chronic pain plaintiffs whereas civil juries awarded $80,895.28. Judges awarded six times as much money for the same injuries.

Know your exposures, from coast to coast

If your business has locations in more than one province, it’s important to be aware of how your liability exposure may be different from location to location.

For example, understanding that a higher frequency of auto claims in Alberta will generate a far different exposure than in Ontario will inform your company’s financial planning and risk mitigation practices.

Of course, nothing beats a safe driver and a thorough, well-executed maintenance program, no matter where you’re located.

Looking for more information?

If you’d like to learn more about exposure variances across the country, contact Aviva’s Global Corporate & Specialty team at gcs.ca@aviva.com

* After removing claims with settlements higher than $1M and claims where we didn’t pay anything.