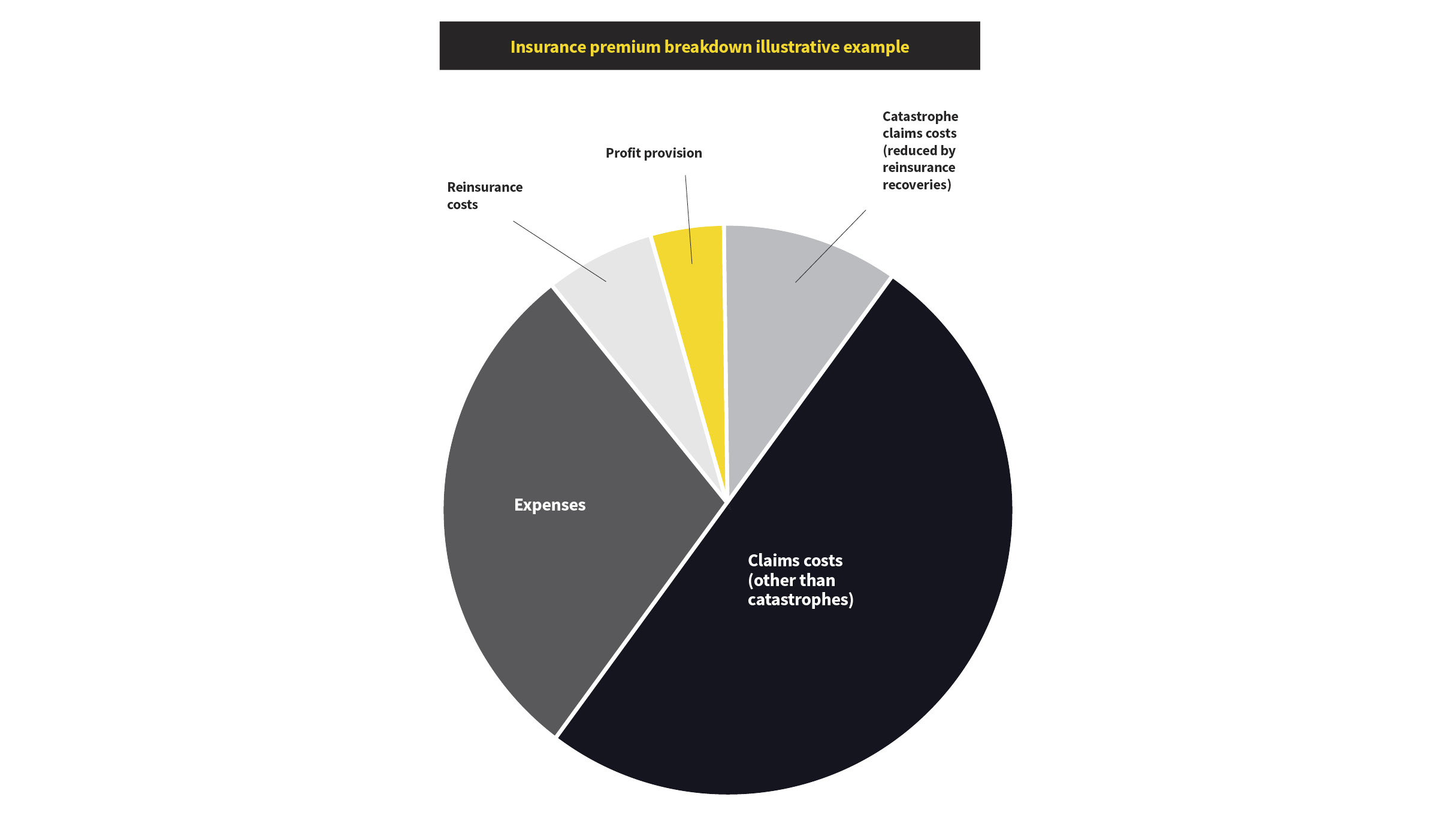

With the significant number of weather catastrophes (CATs) in recent years, it’s natural for insurance customers to ask how this increase in large claims could affect their premiums. The price of insurance premiums factor in considerations such as expected future CAT and non-CAT claims and reinsurance costs, expenses and profit. While CAT events result in large claims reinsurance costs and recoveries, they make up only one part of the premium pricing.

How are premium prices reviewed?

Aviva regularly conducts premium reviews to consider new claims and other data, and will make changes as needed.

Premium assessments are part of the process of consistently predicting future losses, such as adjusting up or down as the costs of rebuilding fluctuate with the economy. Any new information is a good opportunity to review.

How do CTAs factor in?

Catastrophe data is more volatile than regular claims, so pricing and underwriting generally rely on a combination of actual claims data and catastrophe models.

The CAT models include a customer’s specific location and assess things like land elevation, typical rainfall, proximity to forests and more. These models increase our accuracy in predicting exposures to hailstorms, wildfires, floods and other CATs.

The models also consider any defense mechanisms that the community or customer has instituted to prevent catastrophic damage, such as a dam that disrupts the flow of water. This helps us come to a fair premium price that covers realistic risks.

Will the 2024 CATs drive up premium prices?

The spate of CATs in the summer of 2024 will provide additional data points for insurers, reinsurers and catastrophe modellers that will help them review and re-calibrate their pricing and exposure models.

Catastrophe claims data provides a view on potential overall trends in catastrophe events and their impact, as well as more granular views on the types of risks and locations that are most affected.

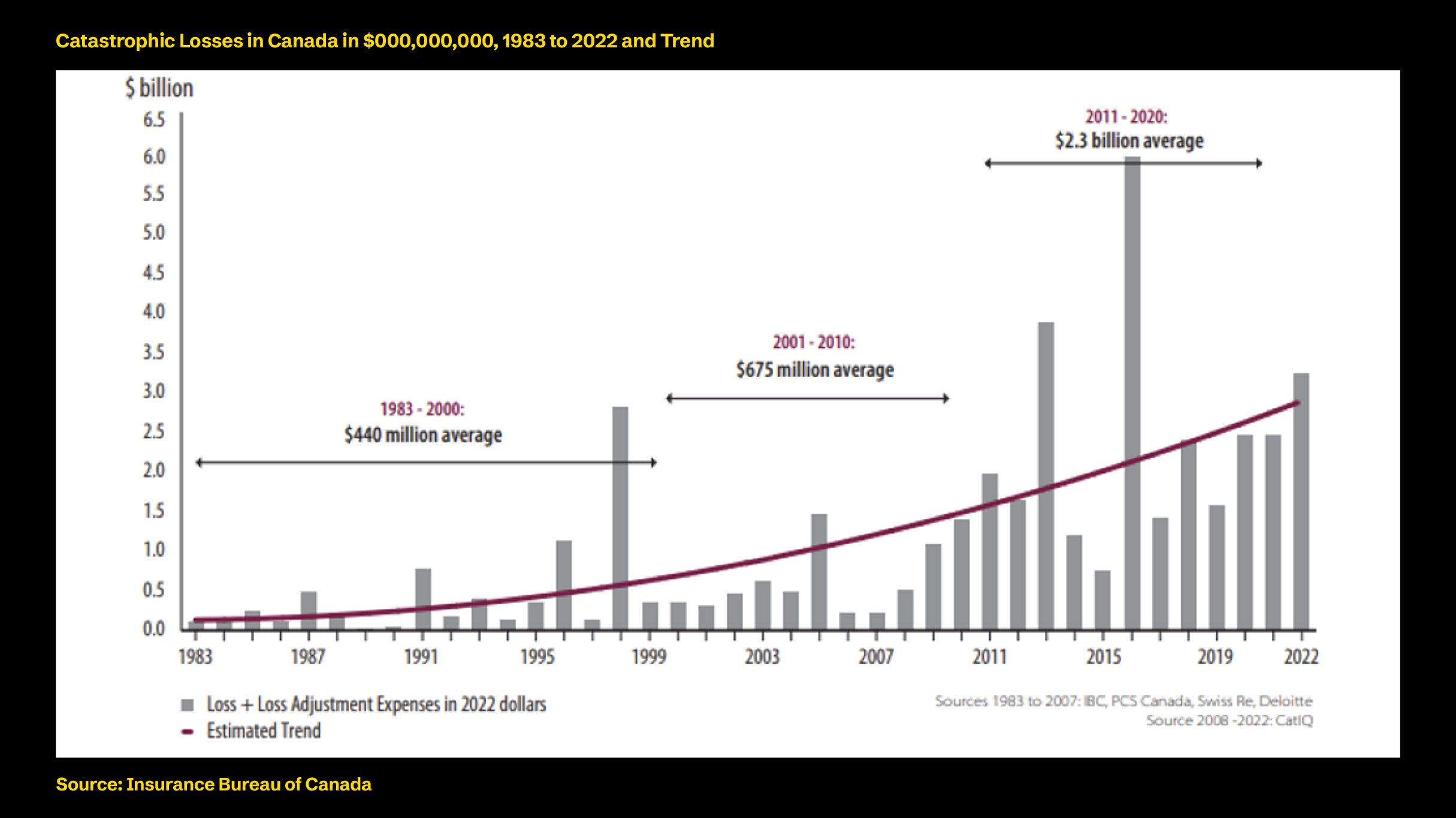

Recent trends have shown that CAT costs have continued to increase over the years and these trends are considered in pricing. The recent events likely further support this increasing trend.

Will your business’s premiums go up next year?

It’s important to remember that every customer’s insurance premium depends on their individual circumstances, including geographical location and risk exposures. While some businesses in higher-risk areas may experience higher premiums in the future based on predictive modeling data, others may be less affected or unaffected.

Aviva works hard to ensure all of our customers have the right coverage for their unique risk exposures at a fair price. It can be helpful to consider what actions you can take to mitigate risks. They are always factored into premium discussions.

Want to learn more?

Reach out to our Global Corporate and Specialty team at gcs.ca@aviva.com