As climate change escalates the frequency and severity of catastrophic (CAT) weather events, modeling technology is becoming an important tool to help insurers more accurately forecast and quantify risk.

Abigail Shahriyar, AVP of catastrophe modeling, exposure management, and reinsurance at Aviva, shared some important information about CAT models — and what they mean for commercial policyholders.

How do CAT models work?

CAT models are designed to assess the financial impact of extreme events such as hurricanes, wildfires, floods and other natural disasters.

Each CAT model is composed of three components:

- The hazard module, developed by scientists, that specializes in specific natural perils being modelled to determine the frequency and severity of them.

- The vulnerability module, developed by engineers, that determines how buildings respond to the events generated in the hazard module.

- The financial module that applies the terms and conditions of the policy to calculate potential financial losses from the combination of the hazard and vulnerability modules on specific locations.

Insurers like Aviva use CAT models to calculate potential financial losses from natural catastrophic events by modelling their portfolio of risks, including key location attributes and policy terms, such as deductibles, limits, and reinsurance arrangements.

Important outputs of these models include metrics such as Average Annual Loss (AAL), which reflects the expected yearly loss, and the Probable Maximum Loss (PML), which estimates the worst-case scenario for a given return period.

These insights help insurers set premiums that accurately reflect risk, structure reinsurance programs, and develop strategies for mitigating exposure to natural peril events.

CAT modelling in action: Hurricanes

An example of the hazard model is the development of the set of potential Named Storm (hurricane) events.

“The events within the model are derived by using a simulation at key points on the path to determine the intensity and direction of the event. This is done for thousands of iterations with different hurricane paths to develop the hazard catalog for hurricanes. Each simulated event is assigned a probability of occurrence which is used within the model to calculate the AAL & PMLs for Named Storm events,” said Shahriyar.

“Aviva uses the output from the catastrophe models to understand potential losses, manage exposure, purchase reinsurance, and premium adequacy to cover the risk.”

Accurate data quality is key for CAT modeling

Like any technology, the quality of data that goes into a model directly affects the accuracy of the model’s output.

“We try to get data that’s as precise as possible. For example, some of our most complex risks are waterfront port structures. If we simply enter the default, such as ‘a wood framed structure’, the model will generate larger results than if we code the risk as a waterfront port structure with mixed construction,” said Shahriyar.

“The most important risk characteristics are the age of the construction, the exact type of construction, the number of stories, and the occupancy codes. The difference in the expected loss for an individual location or policy can be significant when that precision is not included.”

CAT modelling: Precision in action

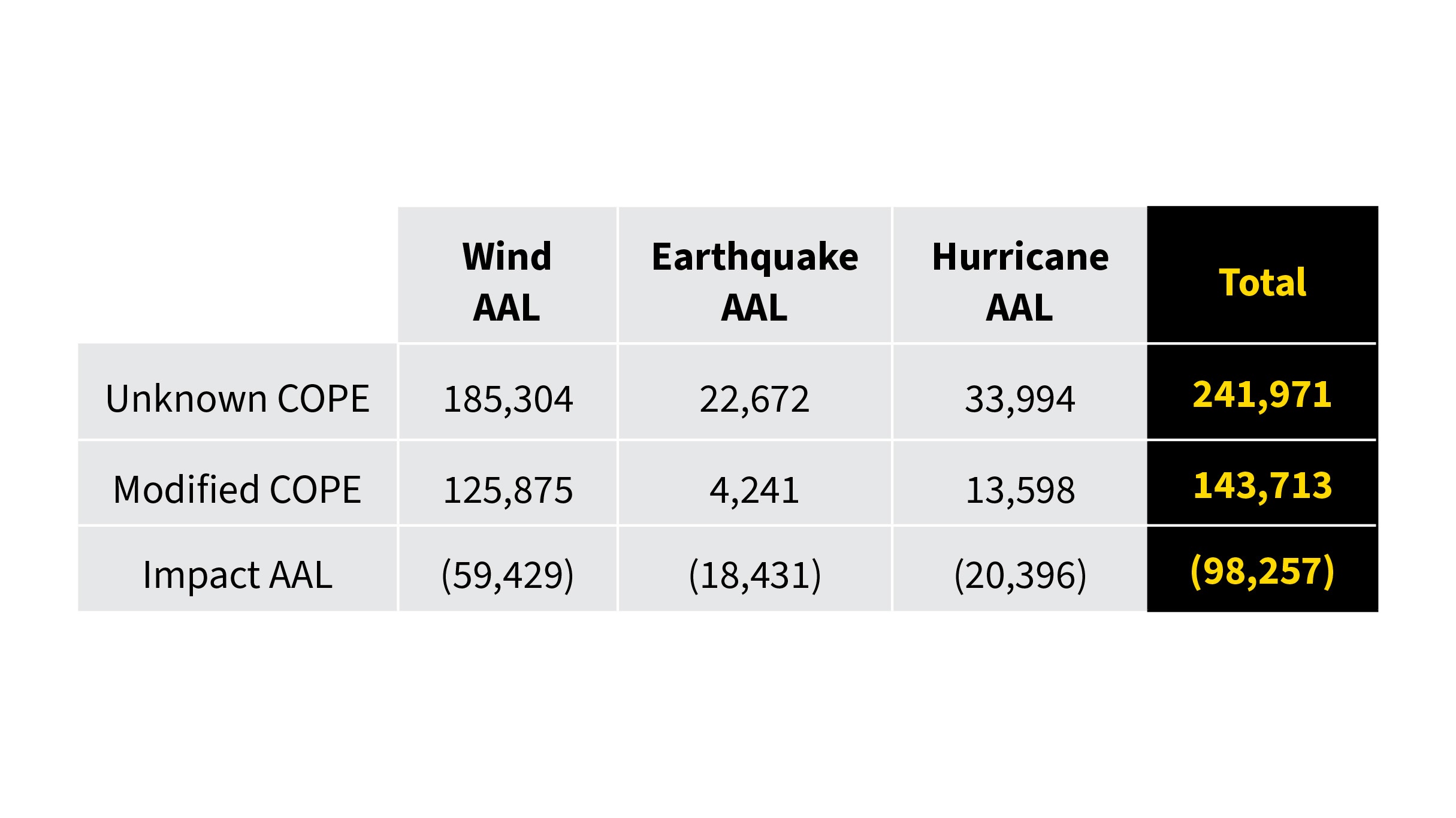

A wastewater treatment plant with 223 locations was presented to Aviva with unknown COPE (construction, occupancy, protection and exposure) information mapped to ATC code for water structures. The model used the average industry characteristics when modelling the account. After working with the broker, the underwriter obtained more detailed information and the team modelled the risk as an industrial facility for water treatment plants. The table below shows the impact to the AAL for the risk.

Modelled AALs drive technical premiums. In this instance, with full risk information, the AAL/technical premium for CAT perils reduced by 40% when compared to unknown risk information.

What is the future of CAT modelling at Aviva?

CAT models currently help Aviva make decisions about how many risks we can manage within our annual capacity. They also help us understand different types of events as they occur and their impact.

Aviva is looking at building more robust pricing algorithms for natural CAT perils. “Using data science tools and data to make a determination for each natural peril will impact Aviva’s view of risk and more accurately reflect each policyholder’s propensity for loss,” said Shahriyar.

“Models give different insights and we’re considering how we can leverage multiple models to develop an Aviva view of risk. Additionally, we’ll be evaluating the impact of climate change on the current model results so that we can make adjustments to the output to more accurately reflect potential losses.

“Models are continuing to evolve as more information is available to scientists and engineers. The more insights we, as an industry, can share, the better the modelling firms can reflect the risks we face.”

For more information

Please speak with your broker or contact us on gcs.ca@aviva.com

*Anonymized to protect the identity of the business