The world around us is evolving at a rapid pace. As technology advances and social inflation continues, the insurance and reinsurance industries are focused on identifying risk trends and challenges that will impact businesses in 2024 and beyond, including new risks that may be difficult to quantify at present.

Here are 3 of the key issues casualty insurers and reinsurers have identified – and what you can do to manage the potential risk exposures they may pose to your business.

1. U.S exposures

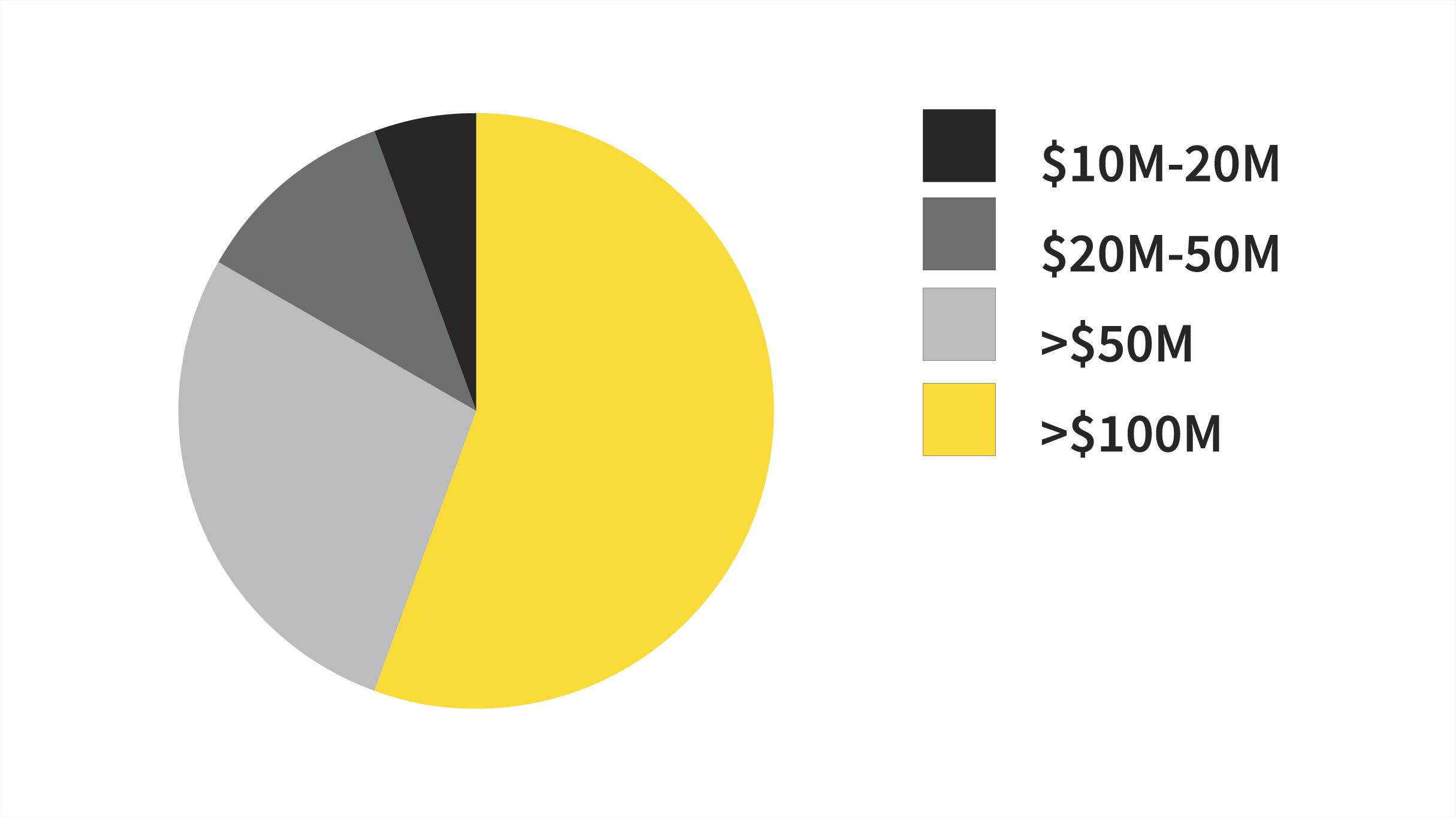

Exposures in the U.S., whether physical locations, operations, transportation or even just sales, are being carefully considered due to increased litigation funding and nuclear verdicts. Nuclear verdicts are exceptionally high court awards or settlements and generally refer to those exceeding $10 million.

The accelerated rise in both the frequency and severity of these verdicts impacts insurance coverage availability and pricing for businesses that have these exposures.

The Institute for Legal Reform (ILR) examined 1,376 nuclear verdicts worth over $10 million from 2010 to 2019. The key takeaway was that the median increased 27.5% over this period, far outpacing inflation.

Another key takeaway from this report was that 1 in 4 auto accident trials that resulted in a nuclear verdict involved a trucking company.

How your business can manage these risks

- Ensure your quality control and risk management practices are up to industry standards. Share them with your insurer so they are apprised of the reduced risk.

- Set enough limits of insurance to fully transfer risk when contracting with a third-party. Seek and have other risk transfer mechanisms/mitigation in place (e.g., contractual agreements/ requirements, hold-harmless agreements, etc.)

- If you’re in the trucking industry, invest in telematics or other monitoring systems. Risk management practices that prioritize safety, maintaining optimal vehicle condition and continued driver training efforts will help control costs and expenses.

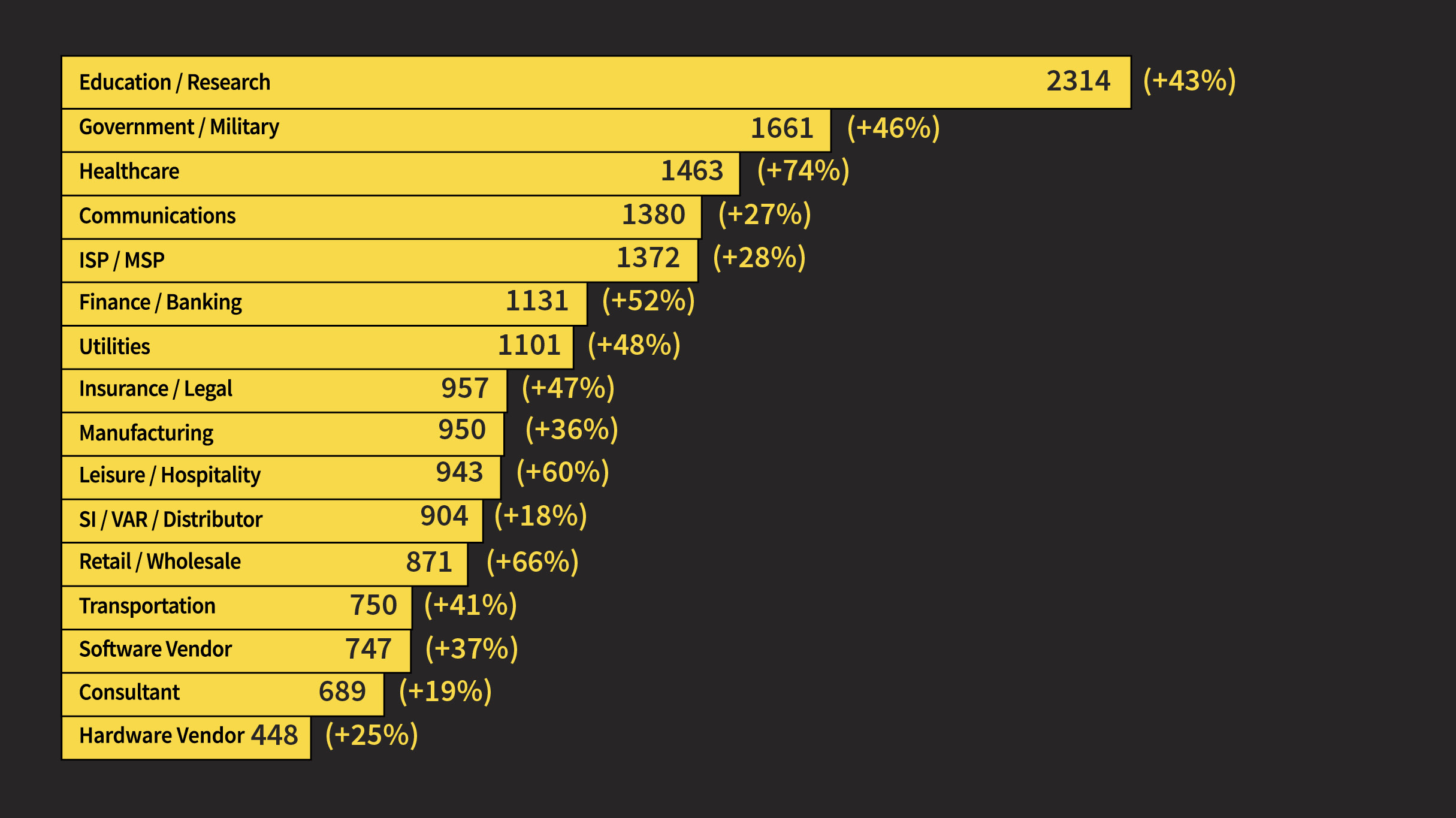

2. Cyber incidents

Digital attacks, including viruses, ransomware and other breaches, have significantly increased worldwide to become one of the most pervasive and rapidly evolving risks.

The primary reasons for this trend include:

- An increased reliance on inter-connectivity between individuals and businesses.

- The COVID-19 pandemic increased the use of digital technology.

- Geopolitical tensions, organized criminal groups and individual bad actors have created an increased risk of malicious attacks.

- Employee errors often lead to privacy breaches or other cyber events.

Any business connected to a network or that holds sensitive data can be a victim of a cyber incident. These can easily result in reputational damage, financial losses, legal liabilities and regulatory penalties.

How your business can manage these risks

- Invest in incident response services to detect and manage cyber incidents in ways that minimize damage, recovery time and costs.

- Provide prevention education to employees and customers.

- Conduct regular phishing tests and vulnerability testing.

- Have a backup centre that is completely separate from your main data centre in case of a cyber incident.

3. PFAS

According to the Environmental Working Group, hundreds of everyday products are made with highly toxic fluorinated chemicals called PFAS (per- and polyfluoroalkyl substances).

These chemicals build up in our bodies and never break down in the environment. They are known as the “forever chemical” due to their non-biodegradable nature. PFAS can typically be found in materials like:

- Fire retardant foam

- Water resistant clothing and materials

- Paint

- Cosmetics

- Non-stick and greaseproof products, including food packaging

- Stain resistant furniture

They can be absorbed by humans through ingestion, inhalation and skin contact. Scientists have made links to various health concerns like cancer and endocrine and other immunological issues.

How your business can manage these risks

- Identify areas within your operation, production process and products where there could be potential PFAS exposures.

- Stay on top of regulatory requirements.

- Be transparent with customers—and your insurers.

By evaluating the potential impact of these risks on your business and implementing proactive measures to mitigate them, you can enhance your business’s resilience in 2024.

Looking for risk management solutions for your business?

Aviva’s Global Corporate & Specialty team is here to answer questions and offer advice. Reach out to us at gcs.ca@aviva.com.