Between 2023’s third and fourth quarters, the number of Canadian businesses that filed for insolvency rose 35%—the biggest jump in 13 years. While that number has since stabilized, the Canadian Association of Insolvency and Restructuring Professionals reports that insolvency filings remain elevated compared to the pre-pandemic figures.

Operating against this economic backdrop, directors and officers (D&Os) of corporations are facing increasing accountability, and their organizations must address D&O risk.

Rissa Revin, a Senior Leader in Financial Line Claims at Aviva Canada, explored this important issue at the 2025 RIMS Canada Conference.

“Bankruptcies are happening in the marketplace because of economic instability and those bankruptcies will cause D&Os to have exposures. Without the right coverage, they or their company will be at risk,” she said.

Here are some of the takeaways that could inform how businesses approach D&O risk.

Flywire a cautionary tale of managing D&O risk

In January 2024, the Canadian government announced a cap on international student permits, significantly reducing the number of foreign students entering the country.

For Flywire, a payment-enablement platform, this change signified the potential for a huge loss of revenue. Since education is the company’s largest industry focus, it depended on international enrollments for revenue.

Although they were aware of the threat to their business, Flywire’s D&Os did not take action. Nor did they raise the alarm to their board or their investors. Ultimately, the company’s stock price dropped nearly 38%.

A US class action lawsuit instigated by their investors alleges that the company, “consistently touted the sustainability of Flywire’s revenue growth and financial condition, while downplaying the anticipated negative impacts of permit- and visa-related headwinds on the Company’s business.”

“This case is important because it’s so realistic. It’s the kind of unexpected impact that can happen to any business,” said Revin.

Learnings from Flywire

Revin says the case offers key insights that can help inform D&O risk for Canadian companies.

Importance of proactive disclosure

Despite being aware of the government’s decision to restrict international students, Flywire’s D&Os didn’t explain or proactively disclose the financial difficulties this presented.

“If a business is depending on foreign students for revenue and that number has been cut, they should have immediately been out in the marketplace to get help, taking action to change the business model, hiring someone to negotiate with the government… letting the board and investors know about the risk,” said Revin.

“No one heard about it until it had already begun to fail and by then it’s too late to turn around or at least shut down what needs to be turned off to survive.”

Policy changes are strategic risks

Modern geopolitical tensions, including conflicts, trade sanctions, and shifting alliances, are reshaping government practices and policies in several areas. One area is immigration and global mobility. This is a significant risk for a business such as Flywire.

Being aware of the environment in which they operate allows businesses to lobby the government, create contingency plans, diversify their business appropriately, and adequately be aware of the strengths and weaknesses of their offerings in the current marketplace.

Reputation management is critical

Although it was the government that made the change that reduced Flywire’s share price, the backlash and ensuing securities class action lawsuit landed squarely in the company’s lap.

The suit, filed on behalf of Flywire’s investors against the company and some of its D&Os, contended that, “Defendants’ public statements were materially false and misleading at all relevant times.”

By failing to be proactive and swiftly address the issue, the reputation of both the company and the D&Os suffered.

Specialty lines claims are advancing more slowly

Revin says it’s important to be aware that there’s an inherent delay in resolving claims borne out of D&O risks.

“Flywire was a singular case in that it was the only entity involved in the lawsuit. Most have multiple businesses and insurers in the mix, and everyone has their own interests,” she noted.

“Usually these are resolved by litigation or other court-appointed professionals coming in to try to resolve the claim. This drives its own expense and delay.”

Examiner and counsel case load also contribute to a long resolution process. Revin says it’s expected that D&O risk claims can take years to resolve. D&O risk has always been an issue for organizations, but Revin says that exposures are going up every year, along with complexity and dollar value of litigation.

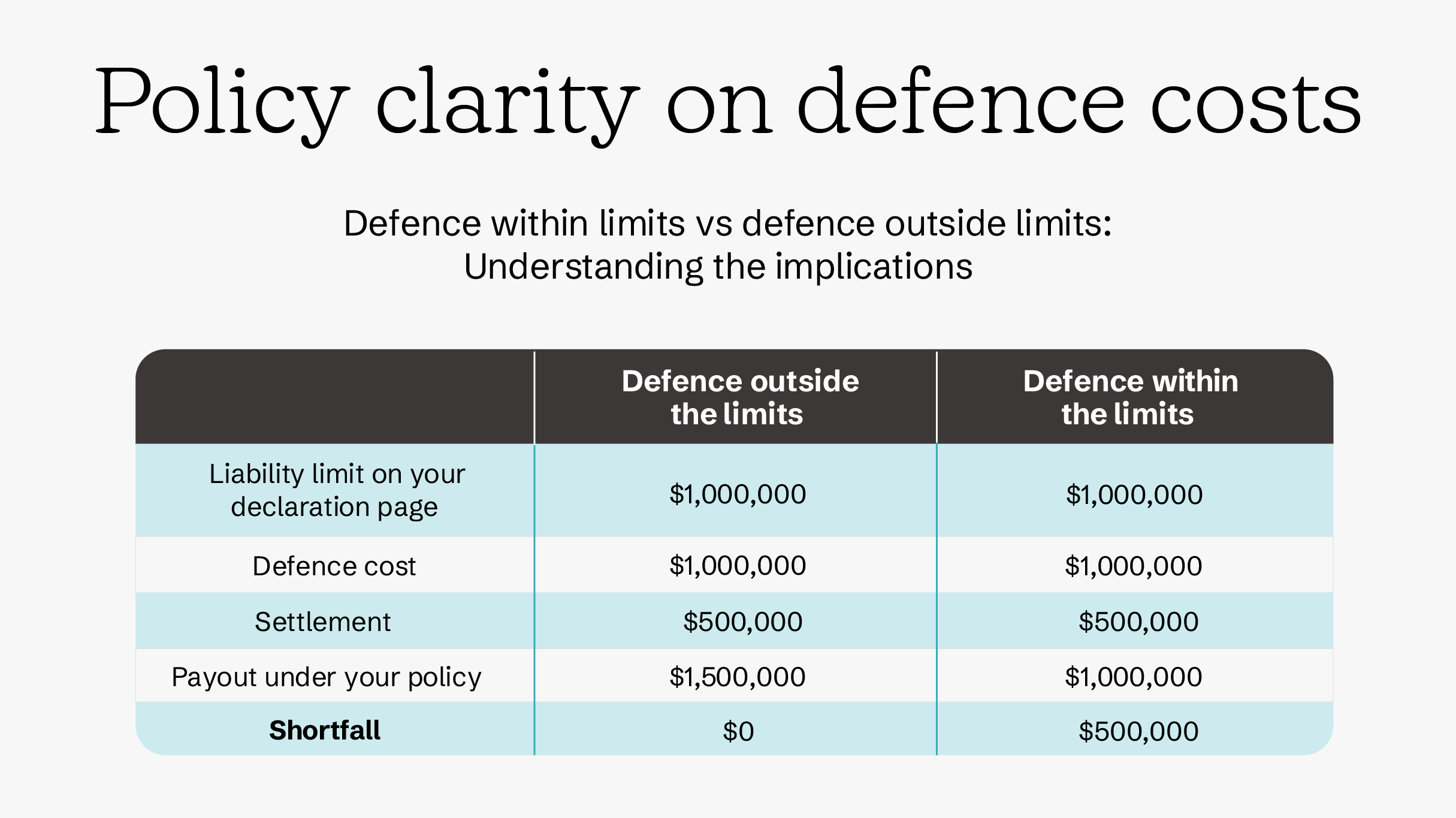

Policy clarity on defence costs

It’s important to be aware of the limits on defence costs in D&O cases. For a long time, defence costs that were spent for the insured while dealing with a claim were outside the limits of liability. For example, if a company had a $50 million limit, their insurer could also have to pay defence costs of all stripes over and above that limit. The limit would only apply to an actual loss.

“It’s now in the hands of the insured about how they want to use defence costs and acknowledging when they are outside their limits and when they are not,” said Revin.

“There’s better policy clarity now on who’s controlling costs.”

*Figures provided are for illustrative purposes only.

Navigating D&O risks

Revin shared some practical tips on managing D&O risks:

- Strengthen disclosure and governance practices: “It’s important for insurers and insureds to be specific about where [policy] money is going. Be clear about how a company is navigating risks, particularly if they’re recurring. There should be ways to figure out how to improve the aesthetic of a repeated issue so you don’t keep getting hit with the same claim over and over.”

- Monitor insolvency risk and financial distress: “Ensure there’s a clear answer about how the company strengthens disclosures to governments and how it monitors financial distress and geopolitical exposures that could have an impact.”

- Review and optimize D&O insurance coverage: “Be aware of what coverages are available, including limits and make sure to right-size the policy for the scope of the risk.”

- Educate and engage the board: “There will be experienced directors who know exactly what to do, but many may be new on a board. Ensure there is someone who can share litigation insights and risk. And identify where there are holes of knowledge so that can be addressed. Scenario planning should be happening regularly.”

D&Os must prioritize foresight and decisive action when facing risk. Effective mitigation requires a commitment to robust governance, transparent disclosure to boards and investors, and constant monitoring of external exposures like policy shifts and economic distress.

By strengthening these internal practices, businesses will meet accountability obligations and build a more resilient foundation to withstand inevitable market shocks and complex litigation challenges. This proactive stance is the ultimate defense against the rising tide of D&O risk.